U.S. forces captured Nicolás Maduro and his wife, Cilia Flores, in Caracas through an operation that included air strikes on military targets. President Trump stated that his administration will temporarily assume control of Venezuela’s governance. Venezuela’s Supreme Court subsequently appointed Delcy Rodríguez as interim president, leaving open the possibility that she could remain in power for an extended period.

Market Reaction: Limited Impact, Targeted Opportunities

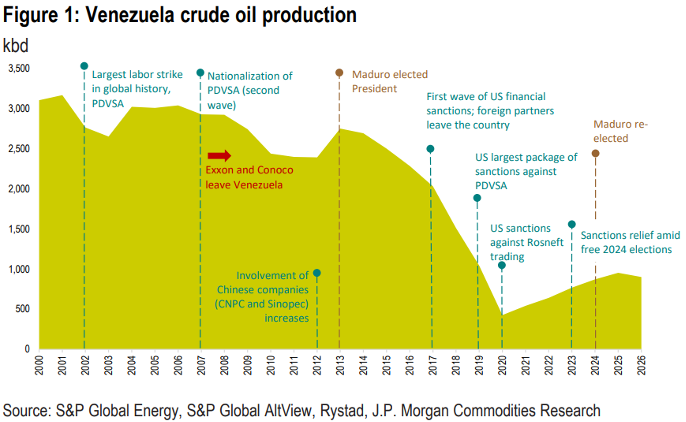

Initial market reactions were concentrated in commodities. Gold prices rose amid heightened geopolitical uncertainty, while oil prices edged modestly lower. Despite holding the world’s largest proven oil reserves, Venezuela’s oil production remains depressed at approximately 900–950 thousand barrels per day. With political stability and renewed licensing, production could increase by roughly 250 thousand barrels per day in the near term, reaching 1.3–1.4 million barrels per day within two years. A more substantial recovery, however, would require investments exceeding USD 200 billion, according to JP Morgan estimates.

From the perspective of traditional financial markets, Venezuela has marginal relevance. Its sovereign debt has been in default since 2017, with total external liabilities estimated at USD 150–170 billion. Nominal GDP, estimated by the IMF at USD 82 billion for 2025, is likely closer to USD 60 billion at current exchange rates—less than half of its pre-crisis size.

Pragmatism Over Idealism: Understanding the Potential Transition Phases

What is unfolding is not a conventional democratic transition, but rather a geopolitical operation consistent with historical precedents. We view the transition as potentially unfolding across three phases:

Phase 1: Containment and Control (Current)

The immediate priority is to prevent institutional collapse and widespread violence. This explains Delcy Rodríguez’s role in ongoing negotiations: she represents administrative continuity across ministries, PDVSA, and the banking system; maintains channels with the armed forces and intelligence services; and retains the ability to execute orders on the ground. In acute crises, operational control often outweighs electoral legitimacy.

Why is María Corina Machado not at the table? She does not control weapons, territory, or logistical infrastructure. For the core Chavista power structure, she represents an existential threat. President Trump was explicit: “I think it would be very difficult for her to be the leader. She does not have internal support or respect within the country.” Secretary Rubio added that “the vast majority of the opposition is no longer present in Venezuela,” further limiting the scope for immediate elections.

Phase 2: Power Rebalancing

Once security stabilizes, civilians, technocrats, and new political figures are expected to enter the process. This phase would involve institutional rebuilding, restoration of basic services, and international normalization.

Phase 3: Democratic Legitimation (Uncertain Timeline)

With functional institutions and contained violence, free elections and broader economic normalization become feasible. This sequencing is consistent with successful transitions observed in the Southern Cone and Eastern Europe.

Path to Reconstruction: Oil and Normalization

Secretary Rubio stated that the oil “quarantine” remains in place, affecting approximately 400 thousand barrels per day of exports, based on public data. Logical next steps would include formal diplomatic recognition and an expansion of licenses, eventually paving the way for debt restructuring.

A fast-tracked bilateral agreement anchored in oil—potentially outside the IMF framework—could lead to a less orthodox restructuring than under the G20 Common Framework. Under our estimates, Republic and PDVSA bonds would likely be treated similarly, potentially incorporating a value recovery instrument (VRI) linked to oil production or prices.

Opportunities for Sophisticated Investors

Venezuelan bonds approximately doubled in price during 2025, and we are currently observing an additional 8–10 point rally this week. In an environment where single-B emerging market sovereigns are trading at five-year low yields (7.6%) and 18-year tight spreads (343 basis points), Venezuela offers a combination of relative value and a compelling normalization narrative.

Given the scale of Venezuela’s oil resources and the U.S. administration’s determination to extract economic returns from its intervention, market participants are likely to remain constructive. Technical analysis suggests value in bonds without collective action clauses and in instruments where accrued interest is less fully reflected in market prices. That said, it is important to emphasize that visibility on a comprehensive debt restructuring remains limited, and there is statute-of-limitations risk for bonds purchased after the publication of the Tolling Agreement in August 2023, which extended the prescription period for defaulted bonds from 2023 to 2028.

For investors with higher risk tolerance, we see emerging opportunities that we are actively evaluating:

Sovereign debt restructuring: Bonds with still-valid maturities and more recent issuance dates could see higher recovery values, particularly as a way to minimize exposure to unpaid accrued interest, which could face significant haircuts in a restructuring scenario.

*Bond secured by 50.1% of CITGO Holdings shares

Traditional Financial Markets

While a potential lifting of U.S. sanctions and renewed investment could support higher oil production, the process would be complex and span multiple years, given decades of underinvestment and infrastructure deterioration. Venezuela currently represents roughly 1% of global oil supply, amid persistent political, legal, and security risks, as well as the structural disadvantage of producing extra-heavy crude, which is less valuable than light crude and reduces its attractiveness to international investors. As a result, we do not currently view this exposure as particularly compelling.

Direct exposure to publicly listed companies outside the energy sector is generally limited relative to oil, given the historical dominance of the state across large parts of the economy (including telecommunications and banking), as well as sanctions and capital controls. In this context, any potential upside for non-energy companies would depend primarily on policy reforms, sanctions relief, and improved legal and financial certainty, rather than near-term operational improvements.

For further discussion or to receive our detailed analysis, please contact your investment advisor at Activest.

Source: Internal analysis Activest