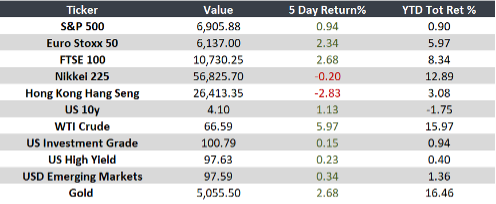

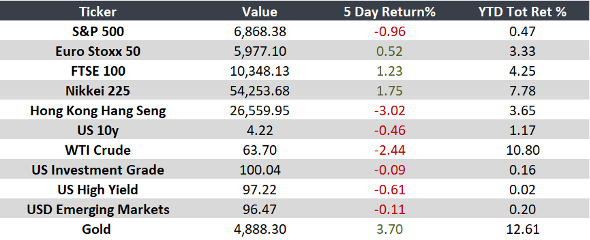

Week of February 16–20 The week brought signs of slowing growth in the U.S., persistent inflation pressures in Europe, and […]

Insights AWM

We share market analysis, economic outlooks, and insights on relevant financial topics prepared by our Investment Committee. This material is intended for informational purposes only and does not represent the views of any individual advisor.

A Practical Taxonomy of Alternative Investments

Understanding the Diversity of Alternatives: From Real Estate to Crypto One of the most common questions I get from new […]

Weekly global macro outlook

February 9–13 The global economy continues to show moderate growth, with inflation easing in developed markets while emerging markets face […]

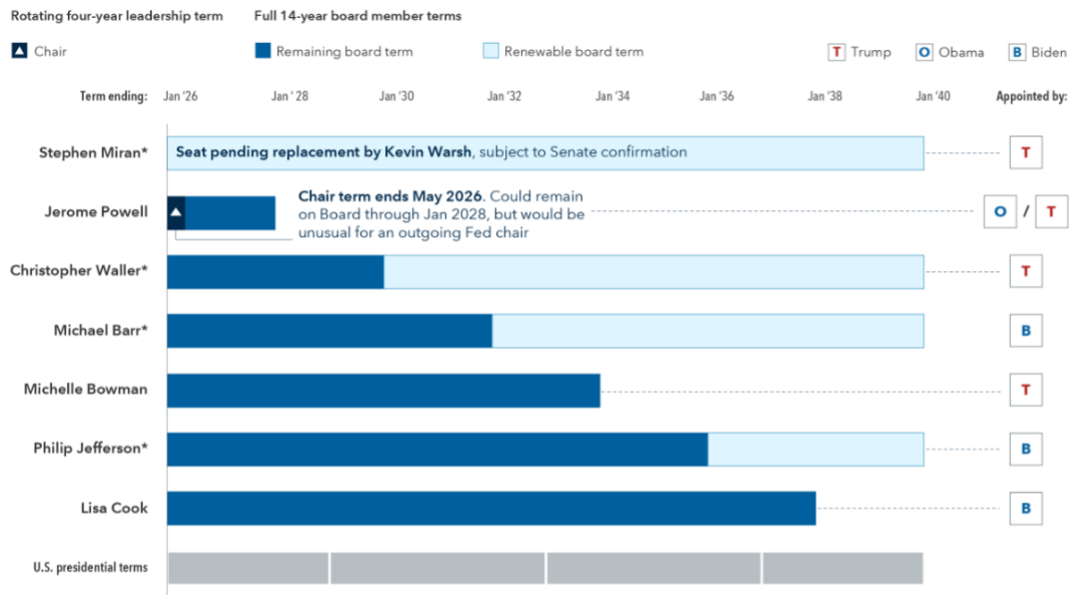

The Fed Enters a New Phase

The nomination of Kevin Warsh as the next Chair of the Federal Reserve marks an inflection point for U.S. monetary […]

Mixed signals in employment, inflation, and global activity

Week of February 2 – 6 The week delivered mixed signals: strong corporate earnings resilience in the U.S., moderating inflation […]

Is Bitcoin the Future? A Critical View

Although Bitcoin was pioneering and revolutionary, its role as the foundation of a global financial system reveals key limitations that […]