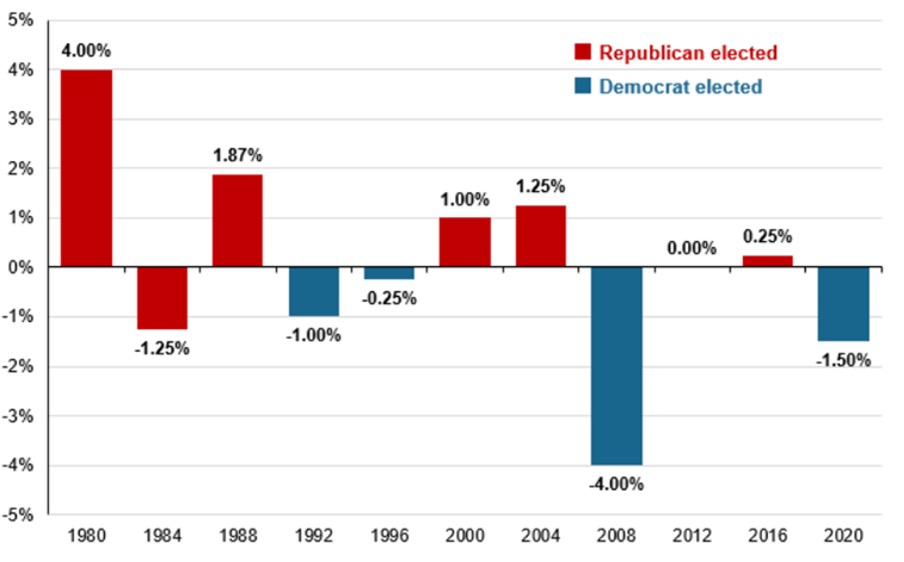

With monetary policy generating much anticipation in the macroeconomic and financial outlook for this year, it is inevitable that investors will wonder how the presidential election might influence the Federal Open Market Committee (FOMC). Historically, the Federal Reserve (Fed) has not stood on the sidelines during election years but has continued to pursue its dual mandate of price stability and maximum employment, always seeking to maintain its independence from politics. Since 1980, the Fed has adjusted rates in every election year, except in 2012 when rates were at zero due to the recovery from the financial crisis.

The Fed lowered rates in five election years and raised them in five others. In 1980, the Fed raised rates by 1% (the federal funds rate, Fed Funds, had hovered around 17% earlier that year). It then cut back rates by 5.5% between February and July as the economy entered a recession. However, it resumed rate hikes to combat double-digit inflation between August and November (the Fed Funds closed that year around 19%). In 1984, the Fed raised rates by 2.25% in the second quarter as inflation rose and unemployment declined, only to reduce them by 3.5% in the fourth quarter as inflation stabilized. In 1988, the Fed began the year with modest rate cutbacks, then raised rates through August and resumed hikes after the election.

On the other hand, in 1992, it concluded the consecutive rate reductions initiated at the beginning of the 1990-1991 recession and implemented its last reduction in January 1996 after the soft landing that followed the 1994-1995 hiking cycle. Also, the Fed concluded its May 2000 hiking cycle, which began in 1999, noting that the stock market was peaking in March 2000.

In 2016, the Fed waited until after the election to hike once in December and continued with rate hikes in 2017 and 2018. It is also relevant that the Fed entered new monetary policy cycles that required an accelerated reaction, as in the severe recessions of 2008 and 2020, respectively.

In this context, it can be seen that the Fed continued to pursue its dual mandate goal, regardless of the political issue. This year is expected to follow a similar pattern, with a potential decrease in the Fed Funds rate as inflation approaches the 2% target, and the economy experiences a ‘soft landing.’

Note: A soft landing in the economic cycle is the process by which an economy moves from accelerated growth to slow growth, potentially reaching a stagnation phase, although it avoids going into recession.

Changes in monetary policy in an election year.

Net change in the federal funds rate, %.

Source: JP Morgan