Private debt under pressure in a more challenging environment

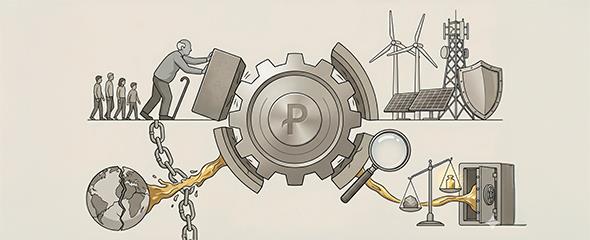

Private debt, though a core component of institutional portfolios for several years, is currently experiencing strong growth. However, a challenging macroeconomic backdrop and multiple structural forces are reshaping the dynamics of private financing.

Aging populations and declining birth rates are reducing demographic growth, further increasing the cost of capital. At the same time, the energy transition, national defense, digital infrastructure, and other strategic priorities require trillions of dollars in annual investment, creating fierce competition for scarce capital.

Additionally, regulatory pressure, deglobalization, and macroeconomic volatility are increasing liquidity risk across certain segments of private debt. While the asset class remains attractive due to its ability to generate above-market returns, a more rigorous assessment of credit risk has become essential.

Key Data:

- Aging populations increase the cost of capital

- Energy transition and infrastructure demand trillions annually

- Regulatory pressure and deglobalization heighten liquidity risk

- The era of cheap capital is over

Conditions have changed. Selectivity and credit quality are now more important than ever. Although private debt offers attractive returns, the current environment demands more rigorous analysis. A disciplined approach to credit quality and liquidity risk assessment enables capturing opportunities without compromising portfolio soundness.

Source: Activest/Axxets Internal Analysis