Destaques da Semana

- In the United States, March inflation advanced 0.4%, similar to February’s figure, although it exceeded expectations of 0.3%. This brought the annual rate to 3.5%.

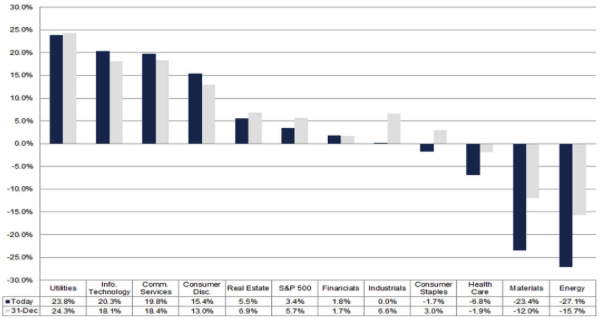

- The quarterly reporting season for the first quarter of 2024 began in the United States with the results of some banks. By the 3rd of May, more than 85% of the S&P 500 companies will have published their results.

- In China, Fitch cut the country’s sovereign debt outlook to “Negative”, citing risks to public finances as the economy faces growing uncertainty.

- In Mexico, the World Bank cut its economic growth forecast for this year from 2.6% to 2.3%.

Important Events in the Coming Weeks

- In China, important economic figures for March will be released 04/15

- In the U.S., the Beige Book will be published 04/17

Monitor