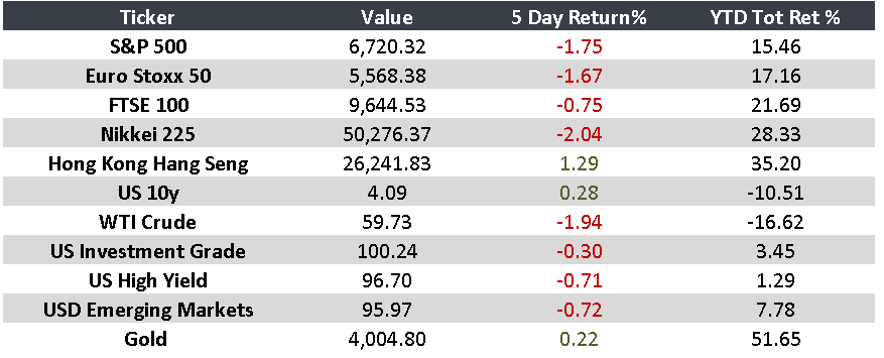

Week of February 16–20

The week brought signs of slowing growth in the U.S., persistent inflation pressures in Europe, and ongoing adjustments across Asia and Latin America. Markets remain focused on inflation, interest rates, and geopolitical risks.

United States

Q4 2025 GDP grew 1.4%, below expectations, impacted by the government shutdown. The Fed maintained a restrictive tone amid persistent inflation and rising oil prices driven by tensions with Iran.

Europe

Germany posted 2.1% inflation and weaker investor confidence. In the U.K., inflation eased to 3.0%, but unemployment rose to 5.2%, reinforcing expectations of a potential rate cut.

Japan

The economy grew 0.2% in 2025, below forecasts. Inflation moderated, while exports surged 16.8%, narrowing the trade deficit.

China

State-owned enterprises are set to acquire real estate projects to reduce excess supply and stabilize the property market, potentially easing economic headwinds.

Argentina

A trade surplus is projected for January, supported by stronger exports and lower imports, reinforcing the Central Bank’s reserve accumulation.

Brazil

Economic activity expanded 2.5% in 2025, driven by the agricultural sector. The environment remains shaped by restrictive interest rates aimed at containing inflation.

Mexico

Manufacturing employment declined 2% in 2025. Banxico is evaluating potential rate adjustments amid 3.77% inflation, while Fitch warned of challenges to the 2026–2030 infrastructure plan.

“The longer you can extend your time horizon the less competitive the game becomes.” – Howard Marks

Key upcoming events

- In the United States, employment-related data will be released on 02/24

- In the United States, Producer Price Index (PPI) inflation data will be released on 02/27

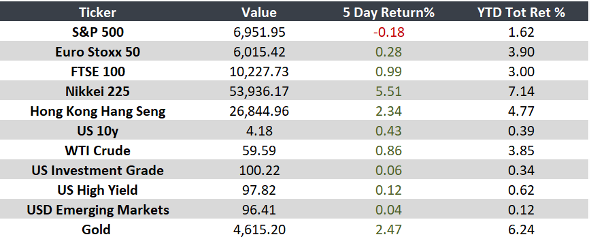

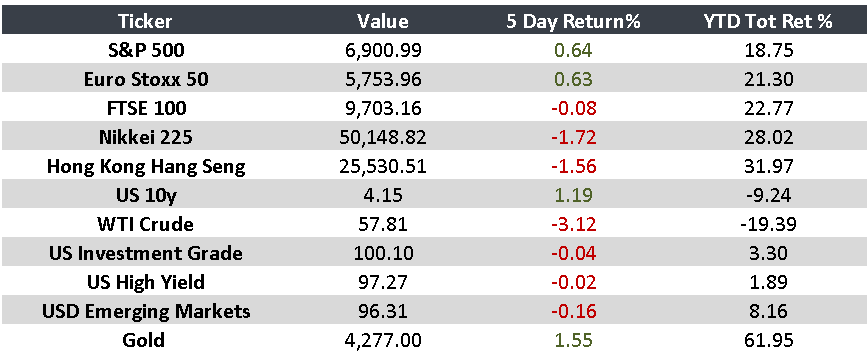

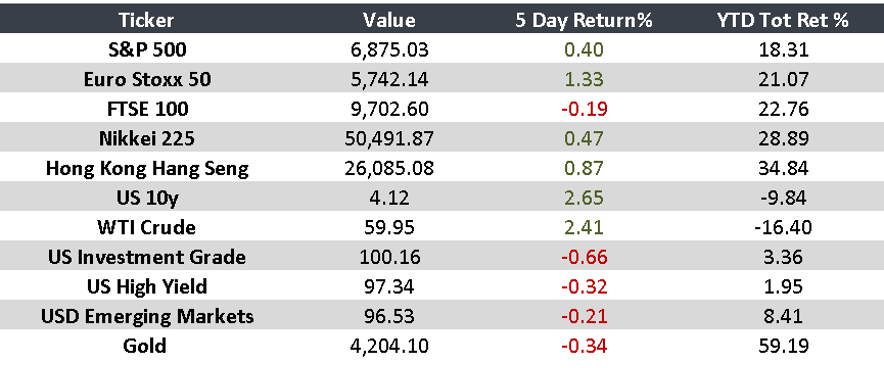

Monitor