Fed’s July Meeting: No Changes, but Signs of Slowdown

July Fed Monetary Policy Statement

As markets anticipated, the Federal Reserve left its benchmark interest rate unchanged, maintaining the target range at 4.25%–4.50%. Unlike the more optimistic tone in June, this time the Fed acknowledged a slowdown in economic activity during the first half of the year.

While the labor market remains strong and unemployment stays low, inflation is still somewhat elevated. As a result, the Committee reaffirmed its commitment to its dual mandate: maximum employment and price stability.

A key highlight was the lack of unanimous support. Two members—Bowman and Waller—voted in favor of a 25-basis-point rate cut. This marks the first time since 1993 that multiple Fed governors have dissented on a rate decision.

Market Implications:

Focus now shifts to the annual Jackson Hole symposium in August, where the Fed Chair traditionally provides guidance on the direction of monetary policy. Markets are still pricing in a potential rate cut in September, which would lower the target range to 4.00%–4.25%.

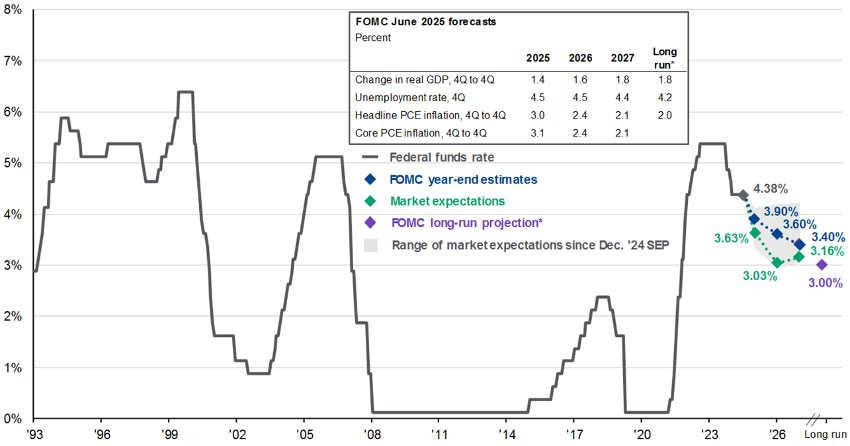

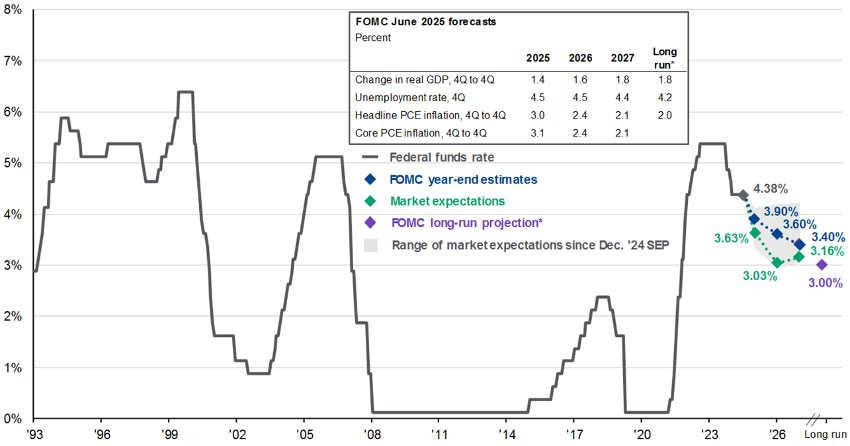

Federal Funds Rate Expectations

Source: JP Morgan