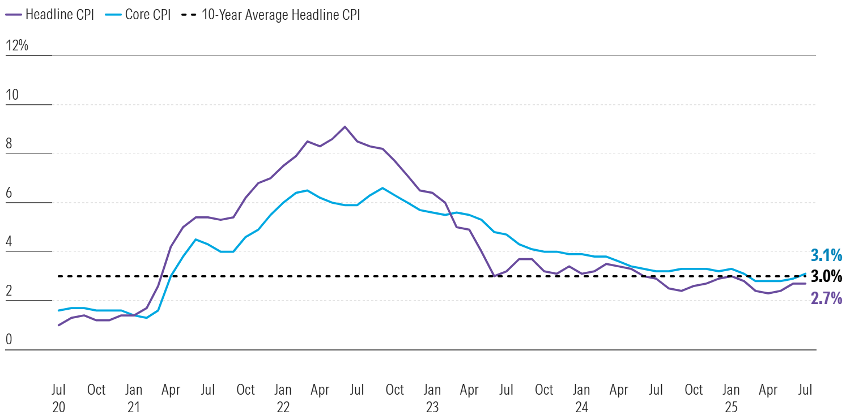

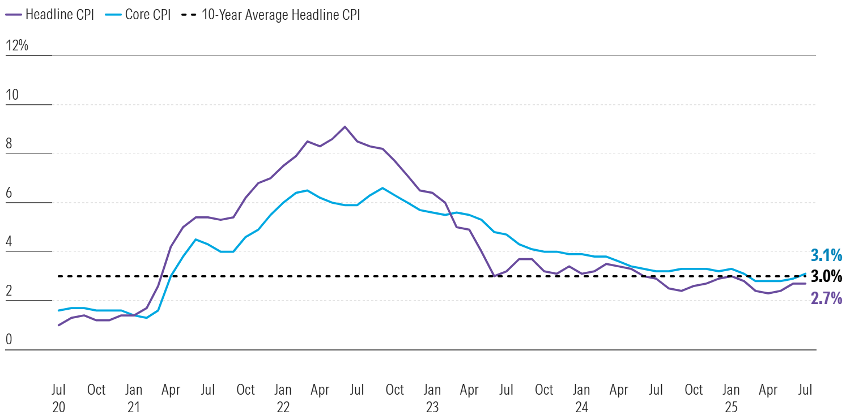

Market eyes Jackson Hole amid mixed inflation data.

The U.S. inflation report for July showed mixed signals. Headline CPI held steady at 2.7% year-over-year, while core inflation rose to 3.1%, up from 2.9% the previous month. This shift reinforces market focus on the upcoming Jackson Hole symposium and the Fed’s September decision.

Other relevant highlights:

- Food: unchanged in July after a 0.3% increase in June.

- Energy: mixed performance – gasoline (-2.2%) and natural gas (-0.9%) fell, while heating fuel rose (+1.8%).

- Shelter: rose 0.2% MoM, unchanged from June.

The Fed continues to monitor the impact of tariffs and their potential inflationary effects. Although two committee members supported immediate rate cuts, the overall tone remains cautious, with emphasis on balancing inflation and employment mandates.

Source: Morningstar