“One Big Beautiful Bill Act”: Key Changes and Potential Impact

Congress has approved President Trump’s fiscal package, officially named the “One Big Beautiful Bill Act” (OBBBA). The proposal includes bold tax adjustments that could significantly impact both economic growth and the country’s fiscal stability.

Here are the main highlights:

Taxes and Deductions

- The 2017 tax cuts are made permanent.

- New deductions of up to $25,000 for income from tips and overtime will apply through 2028.

- A temporary increase in the SALT deduction cap to $40,000 is introduced for households earning under $500,000.

Cuts to Social Programs

- Funding for Medicaid and SNAP is reduced, and new work requirements are introduced.

- In total, food assistance programs are projected to be cut by $186 billion.

Other Measures

- Defense and border security spending increases (around $150 billion each).

- Tax incentives for green energy are eliminated.

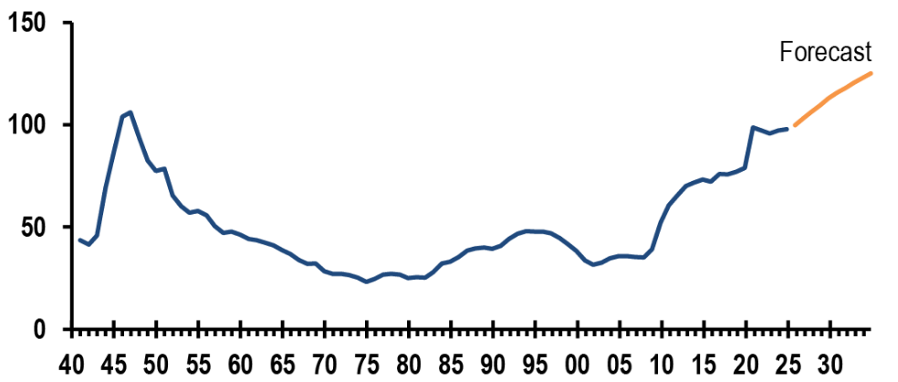

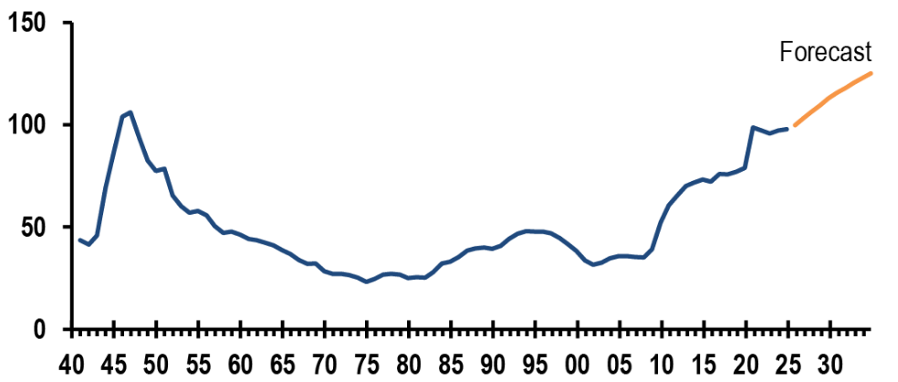

According to the CBO, the package could add $2.8 trillion to the deficit over the next decade. Public debt would rise from 98% to 125% of GDP. This could prompt credit rating agencies to reassess the U.S. sovereign rating.

Market Implications:

The approval of this fiscal package may push Treasury yields higher as concerns grow over the deficit and rising debt issuance. If inflation picks up, the Fed may delay rate cuts—posing challenges for both bonds and equities.

Public Debt-to-GDP Trend (%)

Source: JP Morgan