The Fed Enters a New Phase

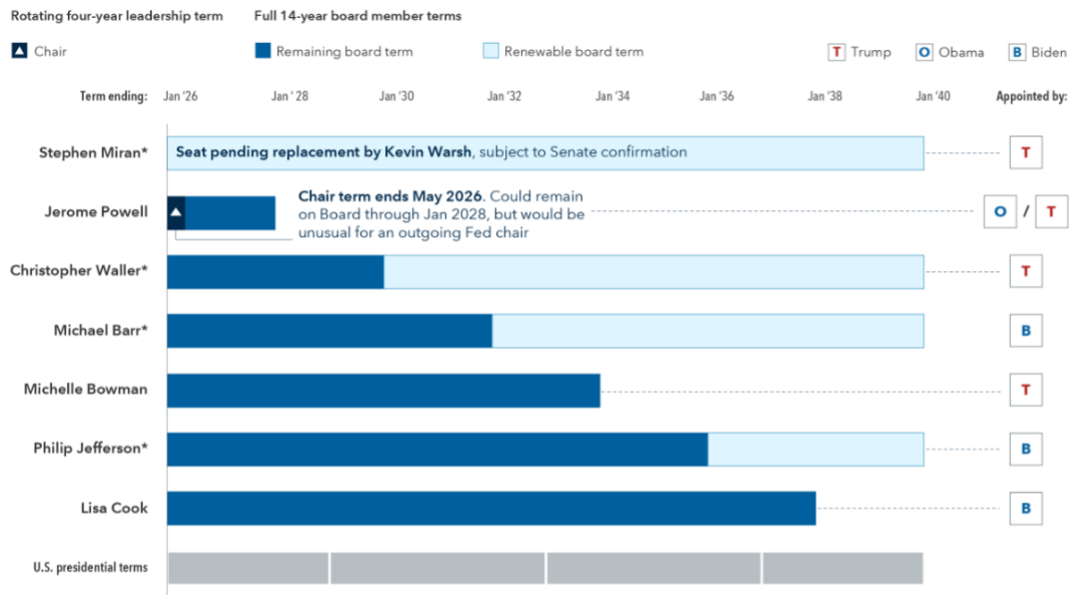

The nomination of Kevin Warsh as the next Chair of the Federal Reserve marks an inflection point for U.S. monetary policy. While he has recently signaled a more pro–lower rates stance, his track record points to a pragmatic, data-dependent approach.

Economic context

With a softening labor market, inflation still above target, and a politically sensitive backdrop, the Fed faces complex decisions. Current signals suggest rate cuts will continue gradually, guided more by economic fundamentals than political pressure.

Market implications

A change in Fed leadership does not automatically imply a loss of independence. Even with a potentially more flexible stance, investors should maintain a long-term investment mindset focused on value creation across market cycles.

Volatility is likely to remain a relevant factor if markets perceive deviations from the Fed’s traditional mandate. This is an environment that calls for careful analysis and a long-term perspective from investors.

Source: Capital Group, Brookings, Federal Reserve