The Fed Pauses Rate Cuts Amid Resilience Signals

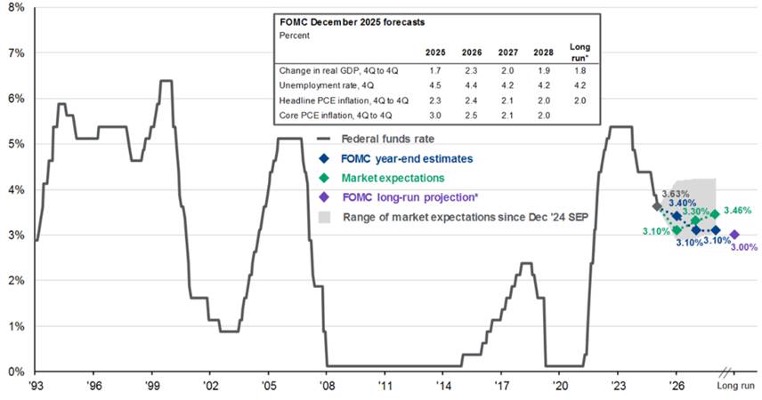

The Federal Reserve kept its benchmark interest rate unchanged at 3.5%–3.75%, signaling a more optimistic view of the U.S. economy. The statement highlighted solid economic growth and early signs of stabilization in the unemployment rate, reducing the urgency for near-term rate cuts.

While two members voted in favor of a reduction, the majority opted for caution amid persistent inflation pressures and a resilient labor market. The decision reinforces the Fed’s data-dependent approach to monetary policy.

Market Implications

Policymakers are balancing inflation control with labor market stability, avoiding premature easing. For markets, this points to a near-term period of stable rates, with the possibility of renewed cuts later in the year if inflation continues to cool.

The tone of the statement suggests less urgency for near-term rate cuts, as policymakers continue to monitor inflation and employment trends. Key takeaway: caution, data dependence, and the potential for policy adjustments later in 2026 if conditions allow.

Source: JP Morgan.