Why does August tend to be a challenging month for markets?

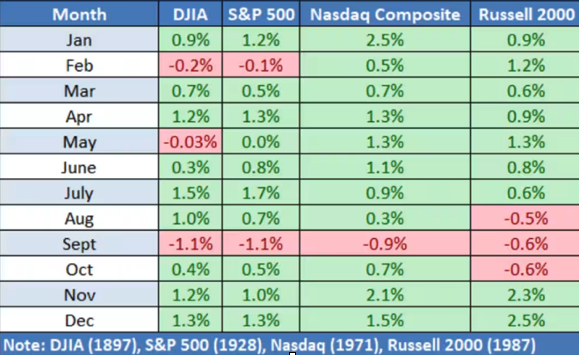

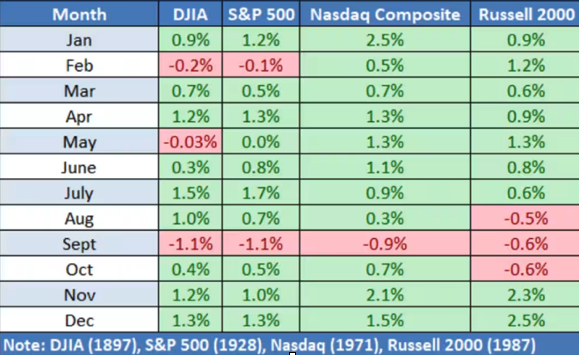

Investors often focus on corporate earnings reports, inflation, or central bank decisions, but there is another factor that also influences markets: seasonality.

Historically, August has been one of the weakest months for financial performance. Since 1950, the S&P 500 has averaged near-zero or negative returns. In pre-election years or after a strong summer, the pattern often repeats. For the Nasdaq, August has been the second-worst month since 1971.

- Lower liquidity: With institutional traders away, market depth decreases.

- Few macro catalysts: August falls between key data and inflation periods.

- Psychological reset: Portfolios are reassessed after summer optimism.

Market implications:

Volatility is not always negative, but it is rarely the result of chance. Therefore, in August as in any other period, patience and a long-term positioning matter more than very short-term performance.