Between tariffs, rates, and inflation, August begins with divided signals in the markets.

Week of August 4–8

The month kicks off with trade tensions and monetary policy adjustments.

The first week of August brings key monetary policy decisions, new tariffs, and mixed signals from major economies. Here’s a country-by-country recap:

- United States: The ISM services index stalled in July, showing higher inflation and weaker employment. President Trump announced new tariffs: an additional 25% on India for purchasing Russian oil, and 100% on semiconductor imports, with exemptions for companies investing in domestic manufacturing.

- Europe: The Bank of England cut its benchmark rate from 4.25% to 4%, though 4 of its 9 committee members voted to keep rates unchanged. The PMI showed a slight expansion in the business environment in July.

- China: The services sector grew at its fastest pace in 14 months, driven by domestic demand. Exports jumped 7.2% year-over-year in July, beating expectations.

- Brazil: The finance minister will meet with his U.S. counterpart as the country seeks alternatives to the recently imposed 50% U.S. tariff.

- Mexico: Banxico cut the policy rate by 25 bps to 7.75%, slowing the pace compared with previous 50 bps cuts. Annual inflation eased to 3.51% in July. The government unveiled Pemex’s 2025–2035 Strategic Plan to make the oil company more efficient and profitable.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.”

— Phillip Fisher

KEY UPCOMING EVENTS

- U.S. inflation data release – 08/12

- Speeches by various Fed members – 08/13

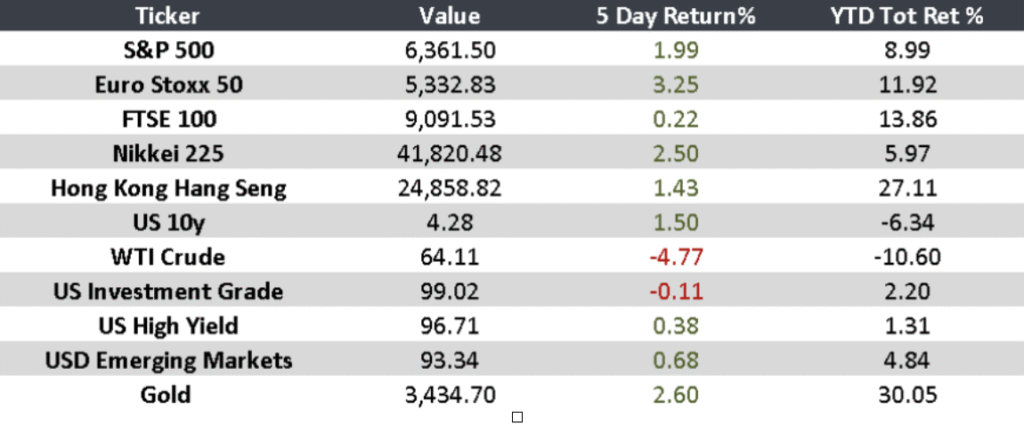

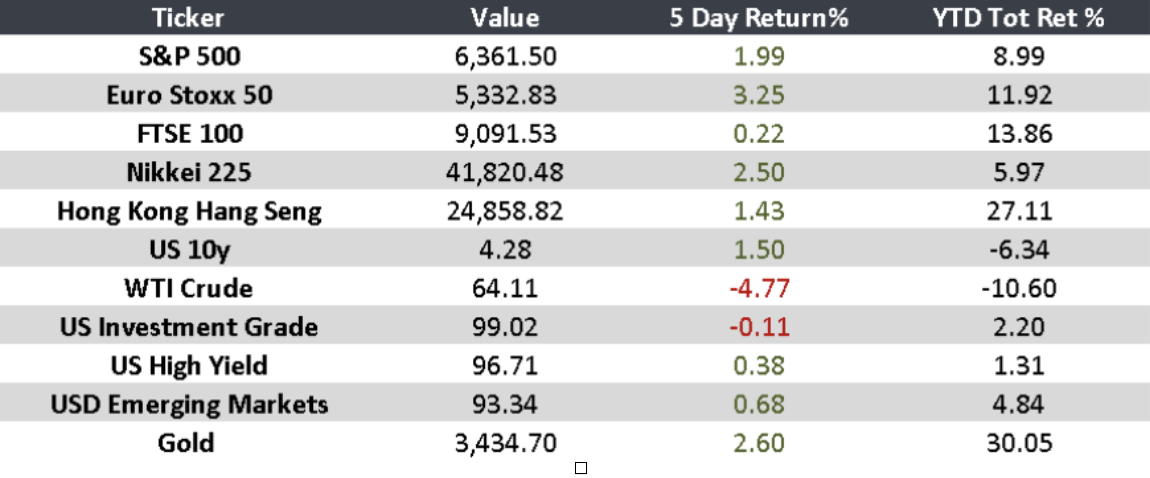

Monitor