Fed splits opinions and key data ahead

Week December 8–12

Markets reacted to the Federal Reserve’s latest rate cut amid a set of mixed signals on inflation, production, and employment across major economies. The week was shaped by U.S. labor data, an industrial rebound in Europe, and contrasting dynamics in Asia and Latin America, reinforcing a cautious outlook for monetary policy heading into 2026.

United States

- The Fed cut rates to a range of 3.50%–3.75%, with three dissenting votes.

- Policymakers signaled only one additional adjustment in 2026.

- Labor cost growth moderated.

- Job openings remained stable, pointing to easing wage pressures.

Europe (Germany)

- Industrial production rose 1.8% in October, the strongest increase since March.

- Growth was driven by machinery and electronics.

- Exports increased 0.1%, supported by intra-EU trade, despite weaker shipments to the U.S. and China.

Japan

- Producer prices rose 2.7% year over year in November, unchanged from the previous month.

- The strongest increases were seen in nonferrous metals and food & beverages.

China

- Annual inflation rebounded to 0.7%, the highest level since February.

- Food prices rose for the first time in ten months.

- Producer prices fell 2.2%, extending a 38-month contraction amid weak domestic demand.

Brazil

- Annual inflation declined to 4.46%, its lowest level since September 2024.

- The Central Bank held its policy rate at 15.00%.

- Authorities signaled a prolonged pause to ensure convergence toward the inflation target.

Mexico

- Inflation rose to 3.80% year over year, the highest reading since June.

- Auto production fell 8.4% year over year in November.

- Year-to-date, production is down 1.5%.

“The single greatest edge an investor can have is a long-term orientation.”

— Seth Klarman

Key Upcoming Events

- United States: Nonfarm payrolls report — December 16

- United States: November inflation report — December 18

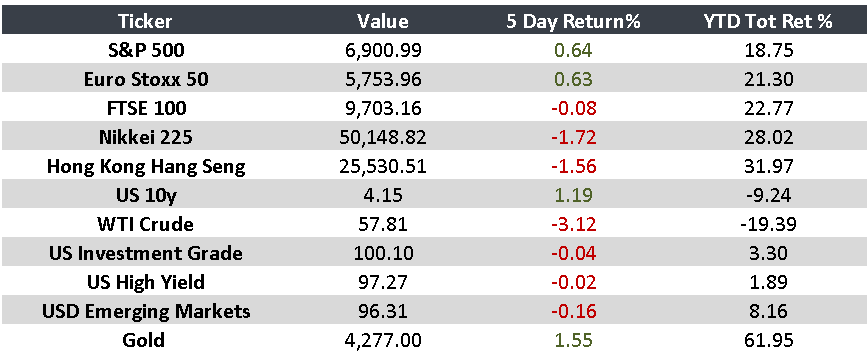

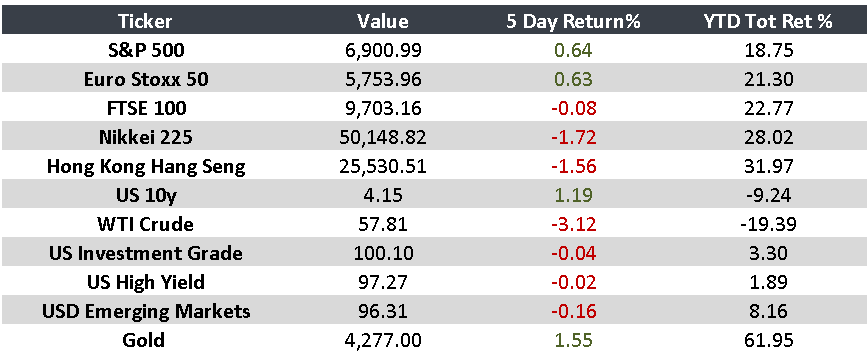

Monitor

Returns as of market close on December 11.