Global outlook: growth and inflation in focus

Week of January 19–23

Global markets reflect a balance between resilient growth, easing inflation in some regions, and persistent pressures in others, shaping monetary policy expectations and economic activity in 2025.

United States

Q3 GDP was revised up to a 4.4% annualized rate, driven by exports, business investment, and strong consumer spending. The Federal Reserve is expected to keep rates at 3.50%–3.75% this quarter, reflecting a cautious stance amid mixed economic data.

Europe

Eurozone inflation closed 2025 at 1.9%, below the European Central Bank’s 2% target. Germany’s economic confidence improved after several difficult quarters, while the United Kingdom continues to face persistent inflation pressures that complicate monetary policy decisions.

Japan

Inflation eased to 2.1% year over year in December. Lower energy prices offset underlying pressures, although core inflation remains above the Bank of Japan’s target, maintaining uncertainty about future monetary adjustments.

China

GDP grew 4.5% in the fourth quarter, weighed down significantly by the real estate sector. Weak consumption contrasts with a late-year rebound in industrial production, reflecting an uneven economic landscape that requires targeted stimulus measures.

Argentina

Economic activity fell 0.3% year over year in November, its first contraction in 14 months, despite solid performance in agriculture and mining sectors. The economy shows signs of weakness in other key sectors.

Brazil

Business confidence improved slightly but remains in pessimistic territory. Concerns persist about the pace of the domestic economic recovery, with worries about sustained medium-term growth.

Mexico

Inflation rose in the first half of the year, while consumption remained strong, supported by higher retail sales and e-commerce growth. The consumer dynamics contrast with moderation in other economic indicators.

Key upcoming events

- In the United States, the FED monetary policy decision will be announced on January 28

- In the United States, the Producer Price Index (PPI) will be released on January 30

“The big money is not in the buying and selling, but in the waiting.” – Charlie Munger

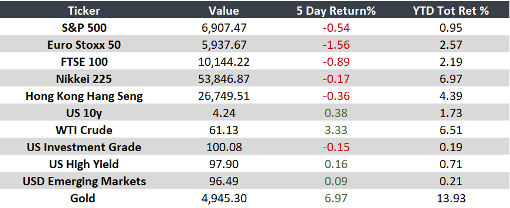

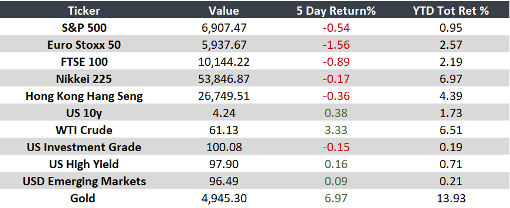

Monitor