Global outlook: inflation, growth, and trade

Week of January 26 to 30

Global markets reflect a balance between solid growth in developed economies, persistent inflationary pressures in certain sectors, and ongoing monetary policy adjustments in emerging markets.

United States

The Fed kept rates at 3.5%–3.75% amid solid growth and stable employment. PPI rose 0.5% month on month, and the trade deficit widened in November, potentially weighing on Q4 GDP.

Europe

Eurozone GDP grew 1.3% YoY in Q4 2025, exceeding expectations. Germany expanded 0.4% YoY, with inflation rising due to food prices, while services inflation eased and consumer confidence improved.

Japan

Service-sector prices rose 2.6% YoY in December. Labor shortages and a weaker yen are pushing costs higher, reinforcing the BoJ’s case for continued monetary policy normalization.

China

The government will prioritize domestic consumption of goods and services in 2026 to reduce industrial overcapacity and external dependence, supporting sectors such as tourism, transportation, and digital services.

Argentina

The IMF reaffirmed a 4% growth outlook for Argentina in 2026 and 2027. Globally, it projects 3.3% growth, conditioned by trade tensions, technology investment, and political uncertainty.

Brazil

Brazil’s Central Bank kept its policy rate at 15.00%. A prolonged pause is expected amid risks from services inflation and FX volatility, with the goal of converging to the 3.2% inflation target by 2027.

Mexico

Mexico’s economy grew 0.7% in 2025, beating expectations. Exports rose 7.6%, driven by non-automotive manufacturing. Unemployment ended the year at 2.4%, and Banxico is considering gradual rate cuts.

Key upcoming events

- In the United States, the Manufacturing Purchasing Managers’ Index (PMI) will be released on 02/02

- In the United States, the Nonfarm Payrolls report will be released on 02/06

“Waiting helps you as an investor and a lot of people just can’t stand to wait.” – Charlie Munger

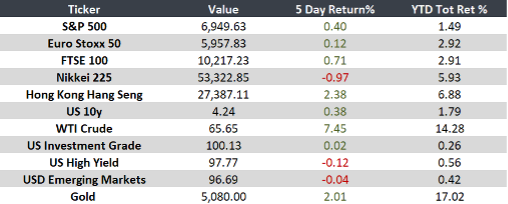

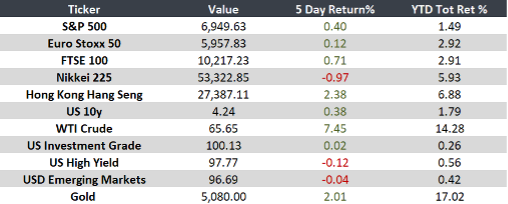

Monitor