Global Outlook: Mixed Signals and Market Caution

Week: October 13–17

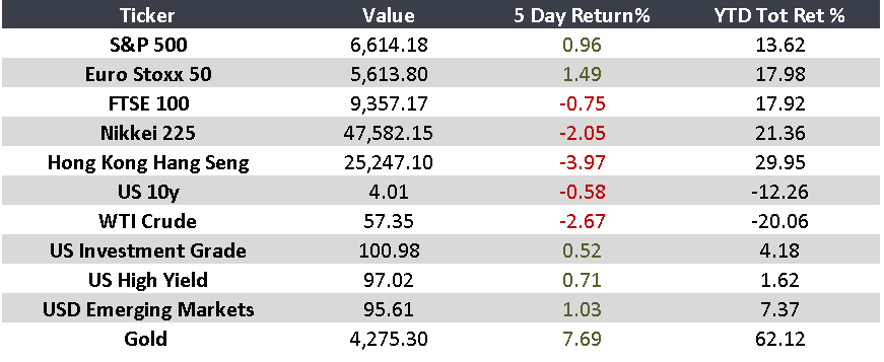

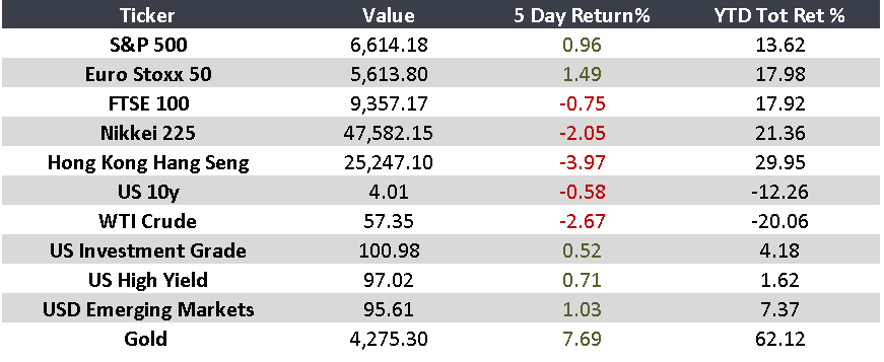

Markets showed a mix of recovery signs and new challenges, driven by trade tensions, monetary policy decisions, and corporate earnings.

United States

- Tensions with China escalated following new statements from President Trump.

- Chair Powell suggested the end of the tightening cycle, opening the door to potential rate cuts.

- Banks reported solid earnings, though volatility persists among regional banks.

Europe

- German investor confidence rose less than expected.

- The U.K. economy grew 0.1% in August, but with downward revisions to prior data.

- The IMF urged the Bank of England to remain cautious, as inflation is expected to stay the highest in the G7.

Asia

- In China, exports rose 8.3% year-over-year in September, the fastest pace in six months.

- Inflation fell again (-0.3%), reflecting weak domestic demand and ongoing trade tensions.

- Producer prices dropped 2.3% annually.

Latin America

- In Brazil, the economy expanded 0.4% in August, below expectations. Analysts expect a deeper slowdown as monetary policy remains tight. The Central Bank maintained its benchmark rate at 15%.

- In Mexico, the IMF projects a fiscal deficit of 3.9% of GDP for 2025 — the highest since 2000. The government is assessing potential tariff adjustments for 2026, depending on U.S.–China trade developments.

“Risk comes from not knowing what you are doing.” — Warren Buffett

Key Upcoming Events:

- China: GDP, industrial production, and retail sales data — October 20

- United States: Consumer prices and new home sales — October 24

Monitor: