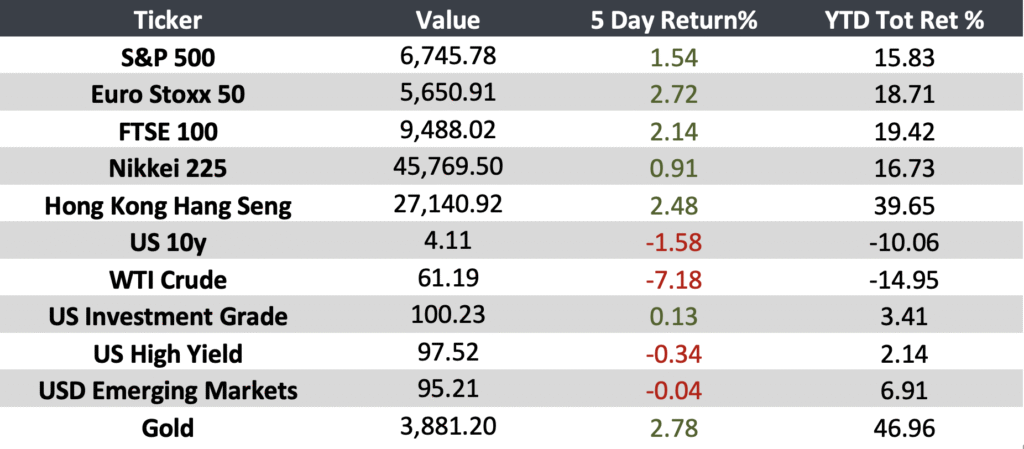

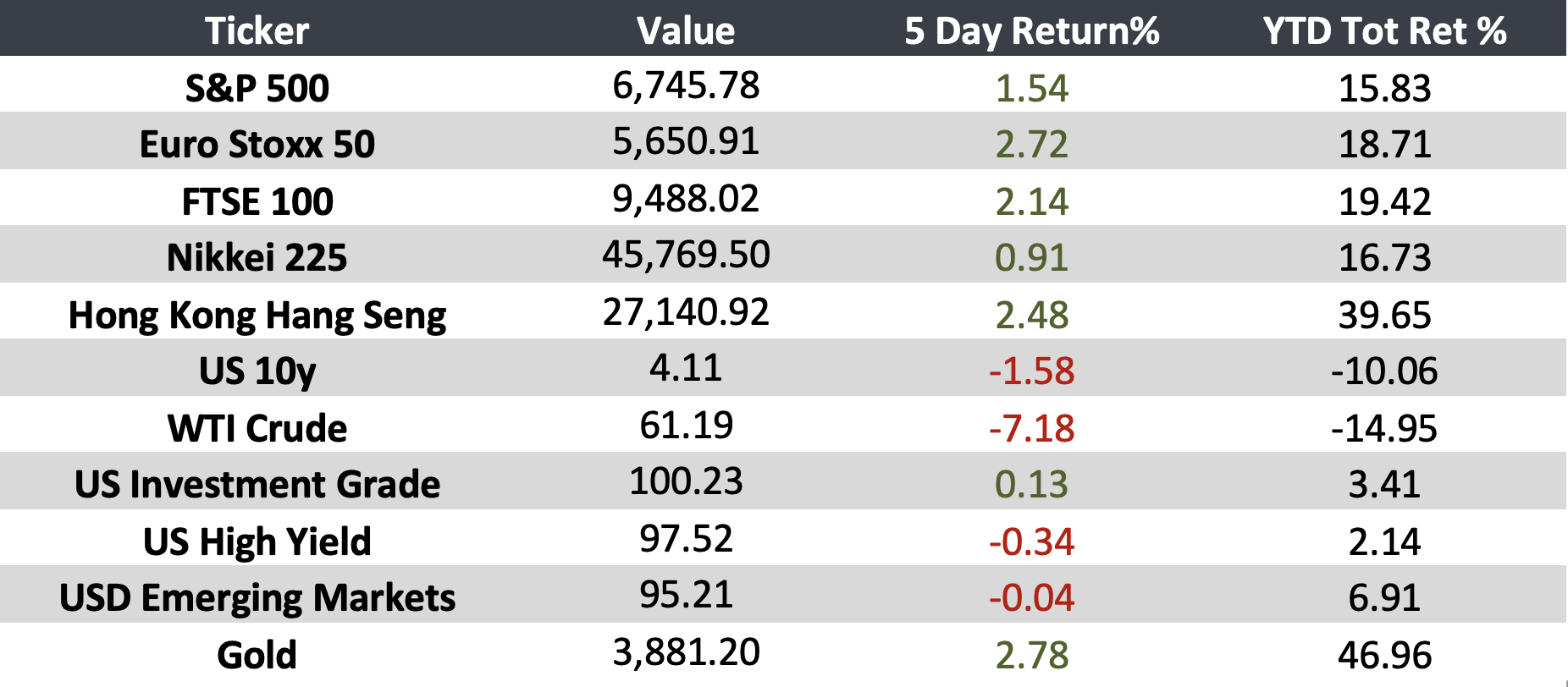

Key Market Moves | Weekly Summary

September 29 – October 3

General Summary: Markets faced mixed signals last week, balancing political uncertainty in the U.S., inflationary pressures in Europe, and weakness in Asia. Meanwhile, Latin America showed resilience in public finances and corporate outlooks.

United States

- The government remains shut down, the first in nearly seven years, delaying official labor data. Still, markets closed higher on optimism for a short shutdown and strong tech sector performance.

- ADP reported a reduction of 32,000 jobs in September, the largest decline since March 2023.

- Consumer confidence fell more than expected, while President Trump announced an agreement with Pfizer to voluntarily lower drug prices.

Europe

- UK GDP slowed to 0.3% in Q2 (vs. 0.7% in Q1), in line with expectations.

- German inflation accelerated to 2.4% YoY, the highest since February, while unemployment rose by 14,000 to 2.98M.

- The European Union plans to double steel tariffs to 50%, aligning with the U.S. against Chinese overcapacity.

Asia

- Japan: Industrial production fell 1.2% MoM, while retail sales dropped 1.1%, the first contraction in over three years.

- China: Manufacturing activity contracted for the sixth consecutive month, awaiting new stimulus measures and clearer U.S. trade relations.

Latin America

- Brazil: Public finances exceeded expectations; debt held at 77.5% of GDP, and the primary deficit was ~BRL 17B (~USD 3B), lower than projected.

- Mexico: Fitch plans to raise Pemex’s rating from BB to BB+ after a USD 10B bond buyback, highlighting closer ties with the sovereign. The government emphasized economic resilience and projects 2.3% average growth in 2026.

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

Important Events:

- U.S.: Fed officials’ speeches — October 7–10

- U.S.: Fed minutes — October 8

Monitor