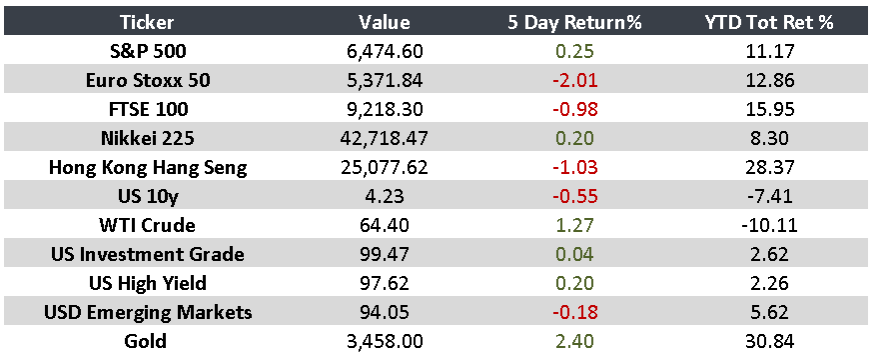

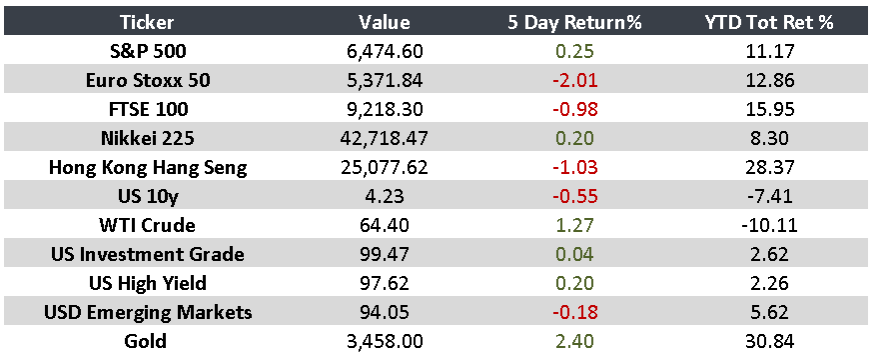

Markets Repositioned: Tariff Impacts and Mixed Data

Week: August 25–29

Global markets reacted this week to renewed trade tensions, macroeconomic revisions, and political moves that increased uncertainty over the global economic outlook. In the U.S., stronger-than-expected data was overshadowed by political interference. In Europe, confidence indicators showed a fragmented recovery. Asia remains cautious amid weak industrial growth, while Latin America faces rising trade and political pressures.

United States:

• GDP for Q2 2025 was revised up to 3.3% annualized, supported by a 1.6% rise in consumer spending.

• Jobless claims declined to 229,000.

• President Trump dismissed Fed Governor Lisa Cook over alleged mortgage fraud, raising concerns about central bank independence.

• A 50% tariff on Indian exports went into effect, impacting $48.2 billion in trade.

Europe:

• Germany’s IFO business confidence index reached a 15-year high.

• However, GfK consumer confidence declined for the third straight month.

• The EU proposed lifting tariffs on U.S. industrial goods, including retroactive cuts on automobiles.

• UK producer prices rose 1.9% YoY in June, the highest in two years.

Asia:

• Japan downgraded its corporate earnings outlook due to U.S. trade policies.

• In China, industrial profits dropped 1.5% in July, despite a trade truce with the U.S.

Argentina:

• The Central Bank raised the reserve requirement by 3.5 percentage points to 48.5% amid electoral tensions and corruption allegations.

Brazil:

• Created 129,775 formal jobs in July, the lowest monthly figure since March.

• Finance Minister Haddad may challenge U.S. tariffs in court.

Mexico:

• Steel exports to the U.S. dropped 16.6% YoY in H1.

• New tariffs on Chinese imports planned in the 2026 budget proposal.

• Mexico and Brazil signed agreements on biofuels and competitiveness during VP Alckmin’s visit.

“Know what you own, and know why you own it.” — Peter Lynch

Upcoming Key Events:

• U.S.: ISM Manufacturing Index – September 2

• U.S.: Employment report – September 5

Monitor