Mixed data and signals of rate cuts

Week: September 2-5

Markets remain attentive to mixed signals on inflation, trade, and monetary policy.

In a week marked by diverging economic data and monetary policy expectations, here are the key points investors closely followed:

United States

- Manufacturing contracted for the sixth consecutive month in August.

- Fed Governor Christopher Waller expressed support for starting a rate-cut cycle in September, leaving room for further adjustments.

- Markets are pricing in a 96% probability of a 25 bps cut at the September 18 meeting.

- Employment slowed in August, with the unemployment rate edging up to 4.3%

Europe

- Manufacturing expanded in August for the first time since 2022.

- Inflation ticked up slightly to 2.1% YoY, driven by unprocessed food and a smaller decline in energy costs.

Asia

- Japan’s manufacturing fell again in August due to weaker foreign demand and U.S. tariffs. The BoJ indicated hikes may continue, though without urgency.

- China, the manufacturing PMI saw its fastest growth in five months, and services posted their best performance in over a year, supported by domestic consumption.

Latin America

- Brazil, the government completed its third external debt issuance of the year, including 30Y bonds at 7.5% and 5Y bonds at 5.2%.

- Mexico, remittances fell 4.7% YoY in July, though they remain at historically high levels. Banxico raised GDP forecasts to 0.6% for 2025. Pemex launched a bond buyback of up to USD 9.9B, with a deadline of September 30.

“Our favorite holding period is forever.” — Warren Buffett

Upcoming Key events:

- China export data — 09/08

- U.S. inflation data — 09/11

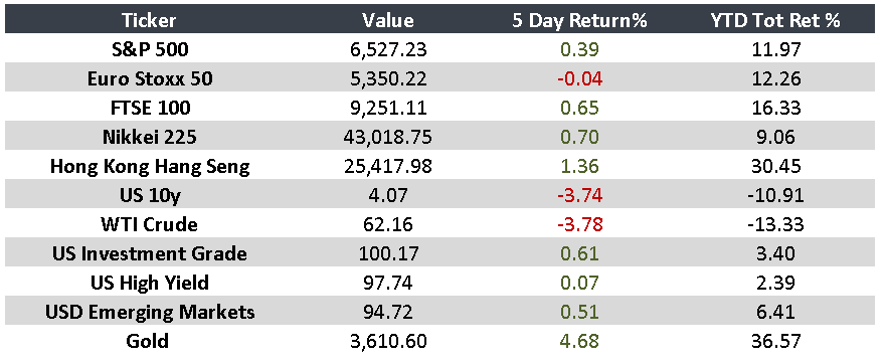

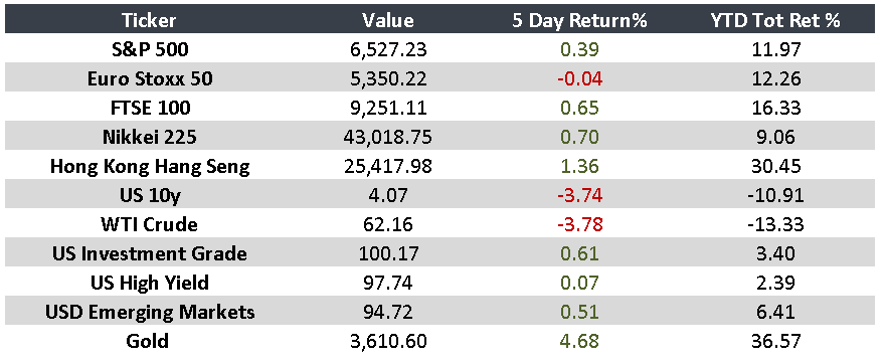

Monitor