Mixed signals in employment, inflation, and global activity

Week of February 2 – 6

The week delivered mixed signals: strong corporate earnings resilience in the U.S., moderating inflation in Europe, and some slowdown across parts of LatAm, while Asia shows early signs of stabilization in industrial activity.

United States

Private job growth slowed, but manufacturing and services remain resilient. Earnings season remains strong, with 80% of companies beating estimates and earnings growing 15% year over year.

Europe

The ECB held rates steady as inflation continues to moderate. Germany posted an industrial rebound, while the BoE showed internal divisions on the rate path.

Japan

Manufacturing returned to expansion after several months of contraction, and services reached their highest level in nearly a year, signaling a gradual recovery in activity.

China

Manufacturing strengthened on higher external demand and production, supporting factory hiring and suggesting stabilization in the industrial cycle.

Argentina

A new agreement with the U.S. on critical minerals aims to accelerate investment and exports, following a record year for the mining sector.

Brazil

Private-sector activity stalled as manufacturing weakness offset services growth, weighing on employment and increasing input costs.

Mexico

Banxico paused rate cuts amid persistent inflation. Remittances declined after record years, and manufacturing remains weak due to tariffs and softer external demand.

“Most people get interested in stocks when everyone else is. The time to get interested is when no one else is.” – Warren Buffett

Key upcoming events

- In the United States, the Nonfarm Payrolls report will be released on 02/11

- In the United States, the Inflation report will be released on 02/13

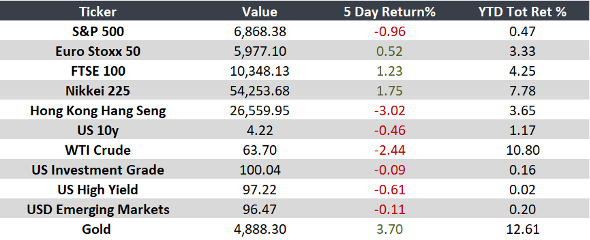

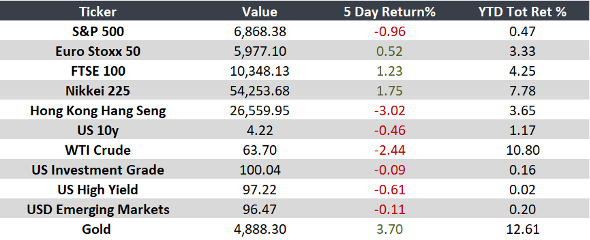

Monitor