Mixed signals: weak manufacturing, moderating labor data, and rising expectations of rate cuts

Week: December 1–5

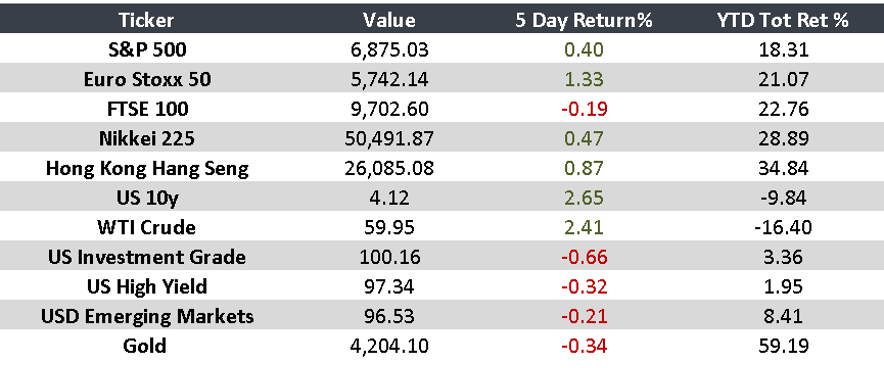

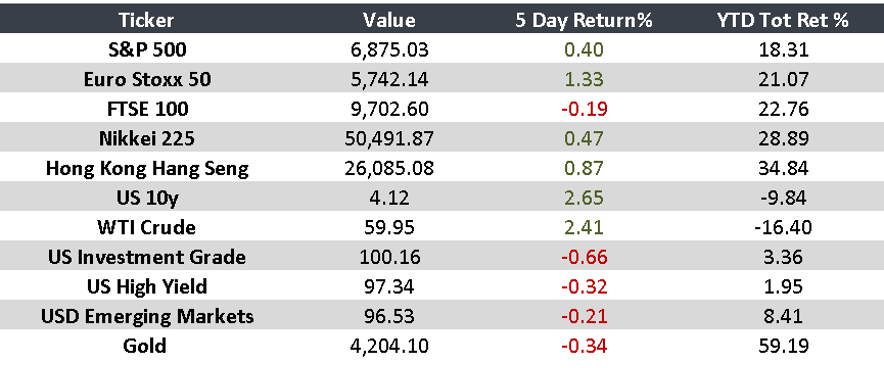

Markets ended the week focused on the persistent weakness in global manufacturing activity and the continued loss of momentum in the U.S. labor market. In this environment, expectations for a potential interest rate cut before year-end strengthened. Europe and Asia showed mixed signals, while Latin America posted contrasting results across growth and income indicators.

United States:

- Manufacturing contracted for the ninth consecutive month, while the services sector recorded its strongest expansion in nine months.

- Private employers cut 32,000 jobs, reinforcing expectations of a December rate cut, now priced with an 87% probability.

Europe:

- The Bank of England reduced capital requirements for the first time since 2008 in an effort to stimulate lending.

- Eurozone inflation reached 2.2% year over year, with services remaining the main driver.

Japan:

- The services sector maintained a solid pace of expansion in November, supported by rising new orders and improved business confidence.

China:

- Manufacturing contracted for the eighth straight month, while services grew at their slowest pace in five months.

- Analysts expect additional expansionary measures to help sustain a growth target near 5% in 2026.

Brazil:

- GDP grew 1.8% year over year in 3Q25, its weakest reading since 2022.

- Agriculture and industry remained the main contributors despite the slowdown.

Mexico:

- Remittances fell 1.7% year over year in October, marking the smallest decline since April.

- The minimum wage will increase 13% in 2026 to 315.04 pesos per day, a cumulative rise of 150% since 2018.

“Risk comes from not knowing what you’re doing.” — Warren Buffett

Key Upcoming Events:

- United States: Employment data release — Dec 9

- United States: Federal Reserve monetary policy announcement — Dec 10

Monitor