Solid growth in the U.S. and Mexico, while key tariff truces remain in place.

Week of July 28 to August 1

Tariff truces, steady rates, and solid growth in the U.S. and Mexico

Global markets start the week with mixed but constructive signals. Below is a brief country-by-country summary:

- United States: The Fed kept rates unchanged for the fourth consecutive time. Q2 GDP grew 3%, driven by consumer spending. An agreement was reached with the EU to cap tariffs at 15%, and the trade truce with China remains in place following new negotiations. Nonfarm payrolls came in below expectations, with 73,000 jobs created in June.

- Europe: Eurozone GDP grew 0.1%, with strong performance in Spain and France. Germany and Italy remain laggards. Inflation in Germany fell to 1.8%, below the ECB’s target.

- China: Industrial profits fell 4.3% in June, and manufacturing contracted for the fourth straight month.

- Brazil: In response to new U.S. tariffs, the government is preparing support measures for affected sectors. The central bank kept its benchmark rate at 15%, signaling the end of its tightening cycle.

- Mexico: Q2 GDP grew 0.7%, beating forecasts. The tariff pause with the U.S. was extended, keeping current rates in place.

“It’s not whether you’re right or wrong that matters, but how much money you make when you’re right and how much you lose when you’re wrong.” — George Soros

Important events in the next week

- In the United States, the ISM Services Index will be released on 08/05

- In China, inflation data will be published on 08/11

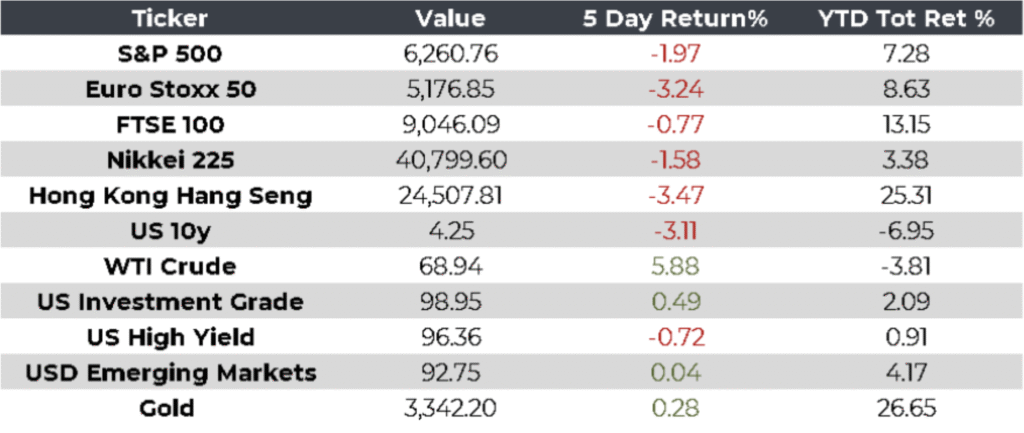

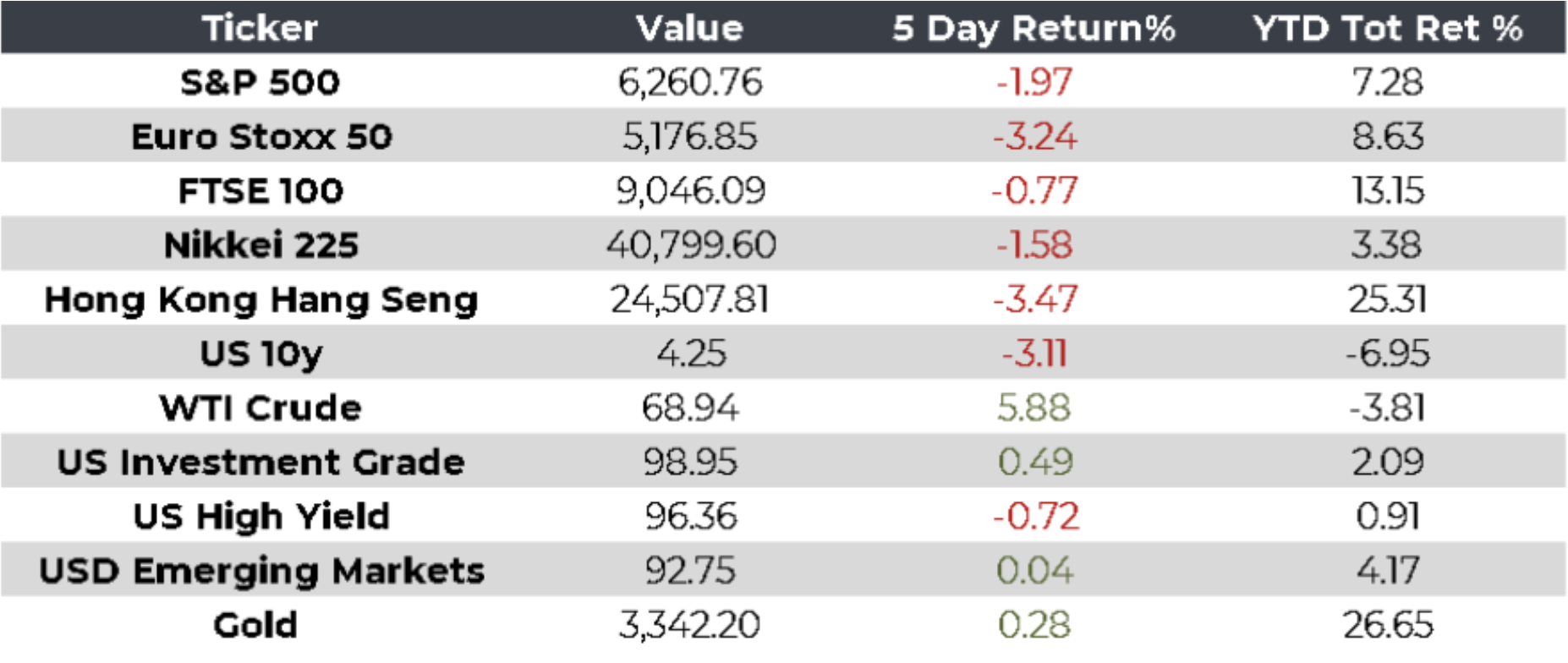

Monitor