Trade and Mixed Data: Signs of Stability in the U.S. and China

Solid U.S. labor market, trade deals with Asia, and monetary pauses in Europe and China.

Week of July 21–25

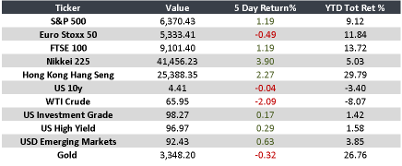

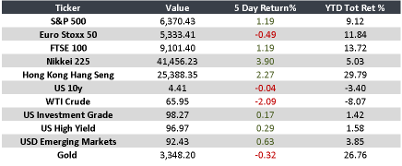

Global Outlook: Stability Amid Mixed Signals

Recent data and key announcements from both developed and emerging markets reveal a landscape of resilience with a few areas of concern. Here are the most relevant highlights from the week:

United States:

- Treasury Secretary Scott Bessent plans to extend trade negotiations with China and will meet with officials in Stockholm. A new trade agreement was reached with Japan, including 15% reciprocal tariffs and $550 billion USD in Japanese investments. Japan will open its market to U.S. agricultural and automotive products.

- Jobless claims fell to their lowest level in three months, reflecting a strong labor market.

Europe:

- The European Central Bank held its benchmark rate at 2%, pausing after four consecutive cuts amid elevated uncertainty.

- Negotiations with the U.S. are progressing toward a potential trade deal with a general 15% tariff, expected to be finalized before August 1.

China:

- The People’s Bank of China kept benchmark interest rates unchanged following slightly better-than-expected GDP data.

Brazil:

- Despite ongoing trade tensions with the U.S., GDP is projected to remain strong, 2.2% in 2025 and 1.7% in 2026. However, if negotiations break down, inflation may rise, with projections of 5.2% for this year.

Mexico:

- The government plans a new bond issuance to support Pemex liquidity, estimated at $7 to $10 billion USD. Inflation declined to 3.55% in the first half of July, down from 4.32% in June.

“The stock market is a device for transferring money from the impatient to the patient.” —Warren Buffett

KEY EVENTS TABLE

- U.S. Federal Reserve announcement – 07/30

- U.S. Employment data release – 08/01

Monitor