Trade tensions and mixed signals dominate the economic landscape

Week of August 11–15

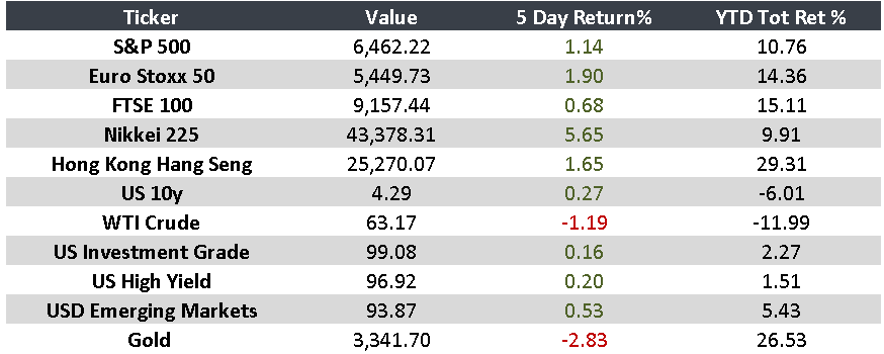

This week, global markets reacted to a series of mixed developments. In the U.S., President Trump extended by 90 days the implementation of new tariffs on China, keeping the current 30% and 10% levels unchanged. July’s inflation came in slightly below expectations at 2.7%, driven by housing costs.

In Europe, German investor confidence dropped sharply amid disappointment over EU-U.S. trade talks and weak economic performance. Analysts expect the ECB to hold rates steady at 2%, marking the end of its current easing cycle.

In Asia, Japan’s producer inflation decelerated for a fourth month, while China posted soft data in retail sales and industrial production. In Latin America, Brazil announced a $5 billion support plan for local businesses, while Mexico highlighted a record trade deficit with China and a historic drop in poverty levels.

“Never invest in any idea you can’t illustrate with a crayon.” — Peter Lynch

KEY EVENTS NEXT WEEK

- U.S. Housing Starts and Building Permits → August 19

- FOMC Meeting Minutes → August 20

Monitor