Destaques da Semana

- In the United States, the February nonfarm payroll rose in 275,000 jobs, exceeding the 200,000 job expectation. Meanwhile, the unemployment rate rose to 3.9% from 3.7%.

- In the United States, Jerome Powell told legislators that interest rate cutbacks will depend largely on the direction of the economy.

- In China, the government announced a growth target for this year of “around 5%” and the issuance of special bonds for large projects.

- In Brazil, the debt to GDP ratio rose to 75% in January, an increase of 70 basis points from December. This increase was due to the impact of accrued interest on debt.

Important Events in the Coming Weeks

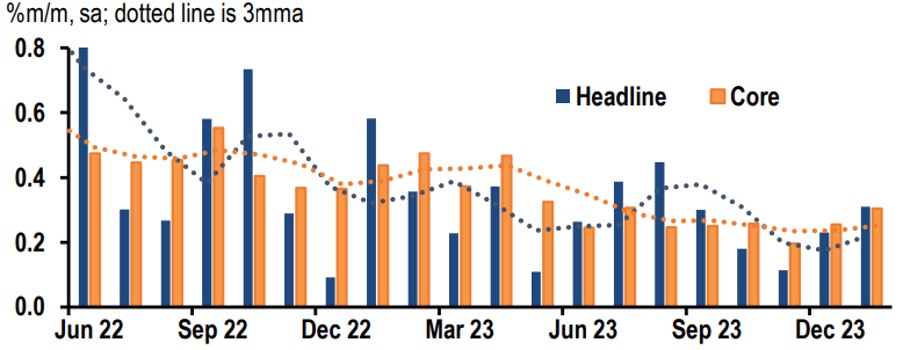

- In the United States, February’s inflation to be announced 03/12

- In the U.S., industrial production will be published. 03/15

Monitor