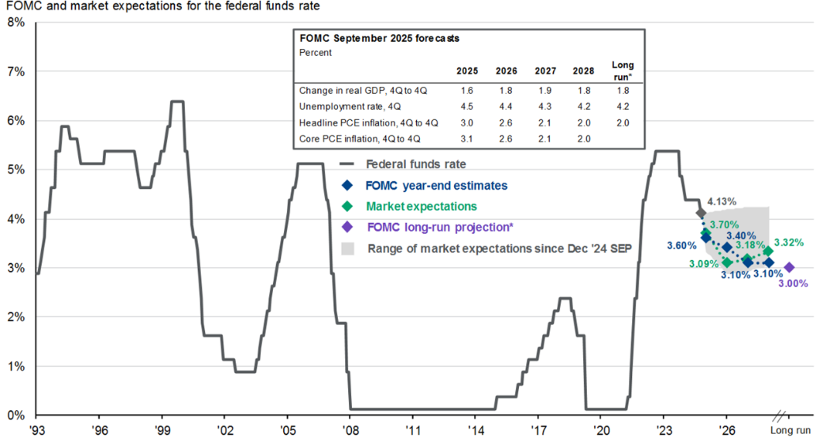

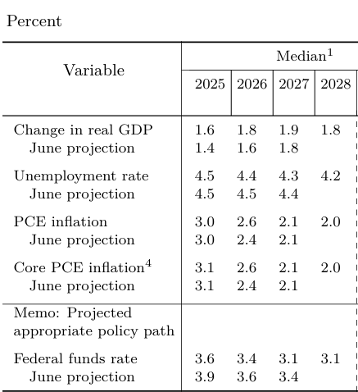

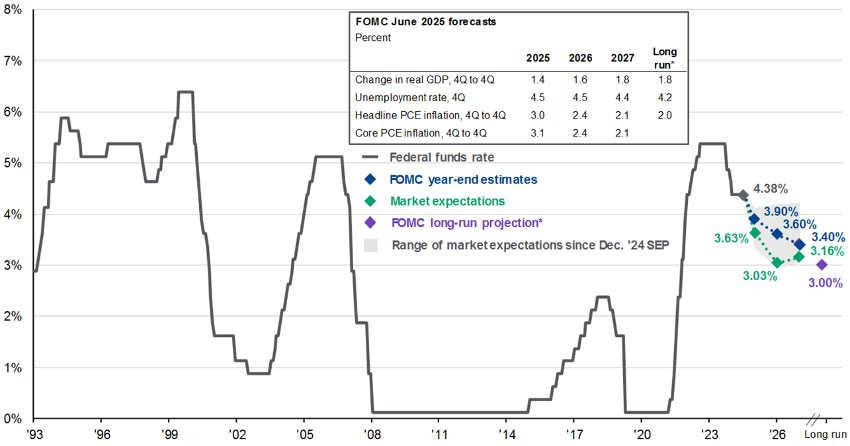

The Federal Reserve has not reached a clear agreement on its next steps.

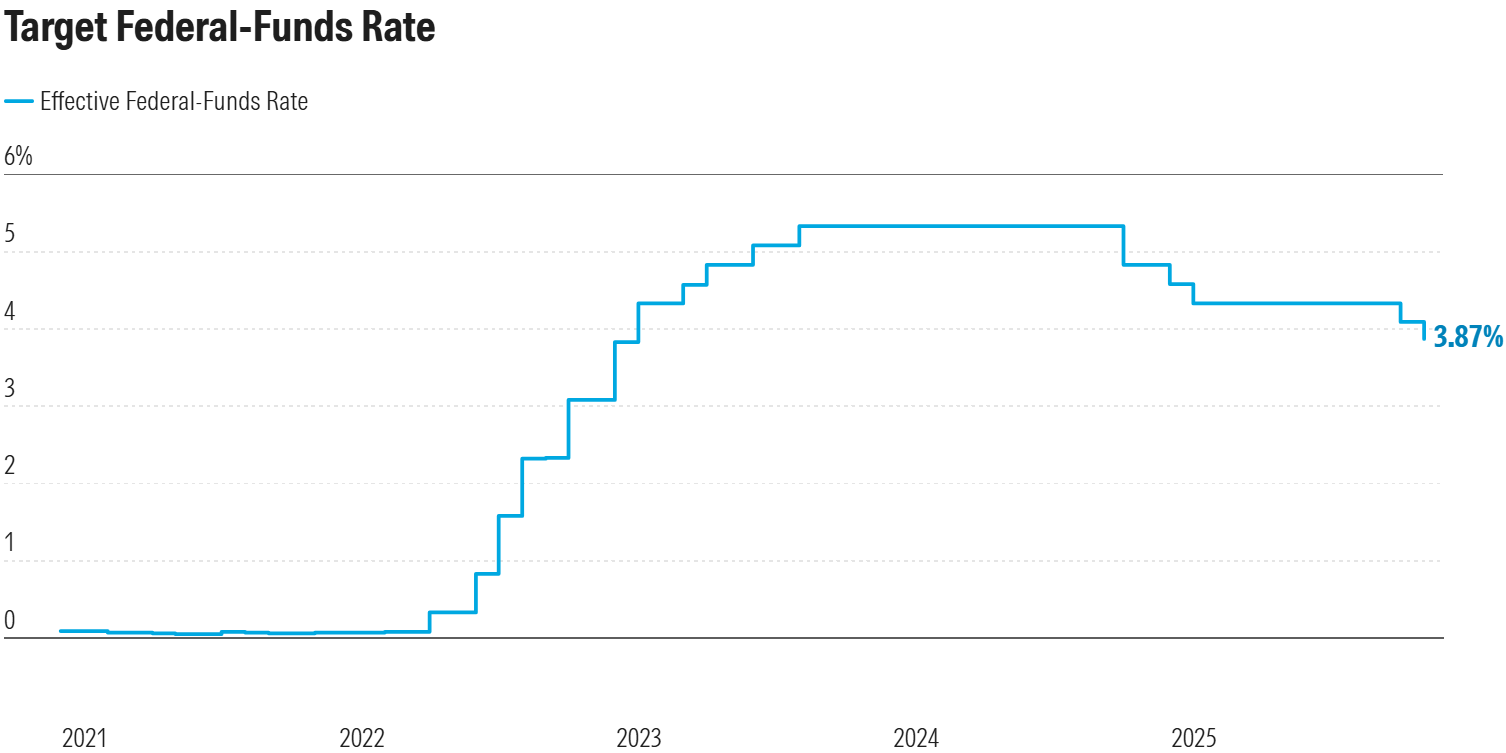

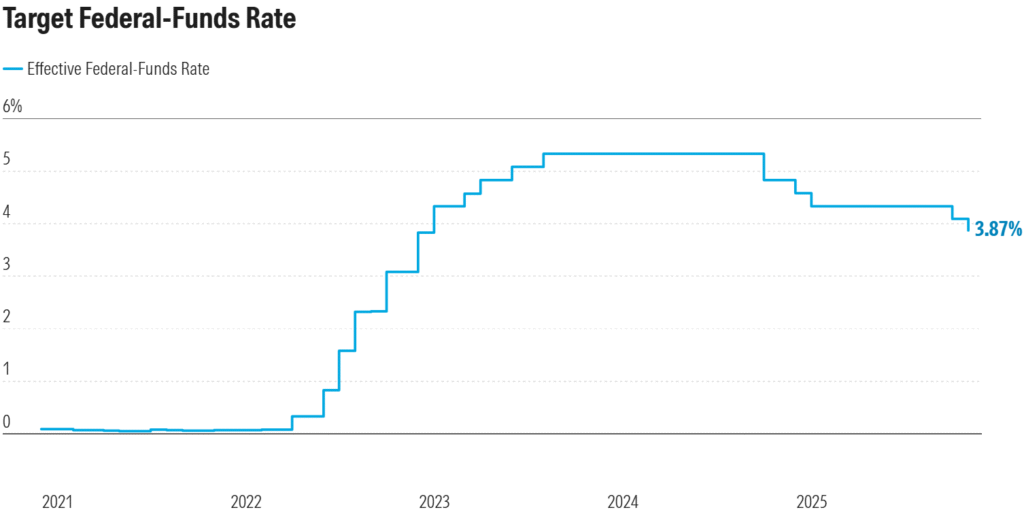

A few weeks ago, the Fed cut its rate by 25 bps, but the real surprise came from the vote: one member called for a deeper cut, while another preferred none at all.

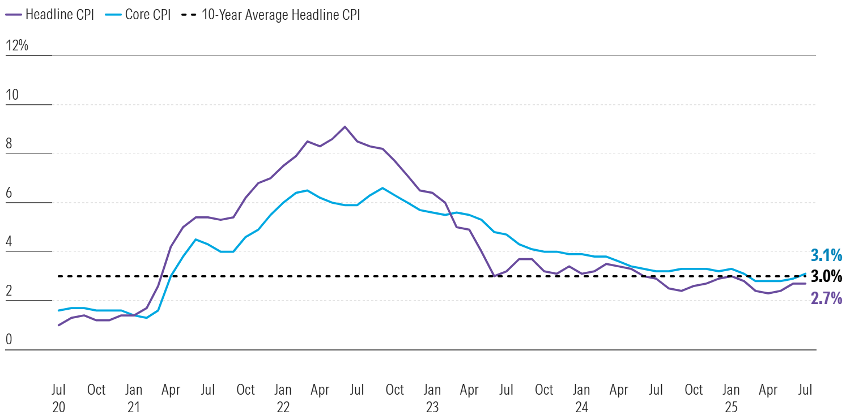

Two opposing positions that reveal an important fact: the economy is sending mixed signals.

In this scenario, Jerome Powell was clear: a December cut is not guaranteed.

Rather than dysfunction, this division shows that the path ahead remains uncertain.

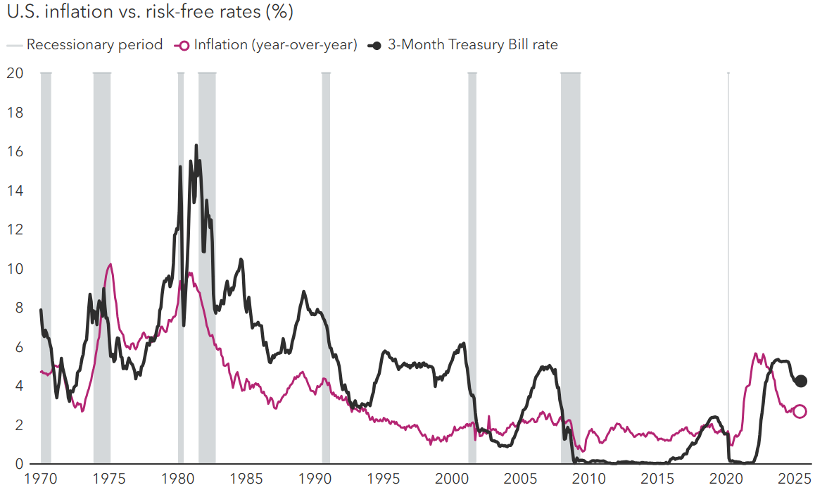

Why is the Fed divided? Because economic data continue to send conflicting and inconsistent signals.

Key points:

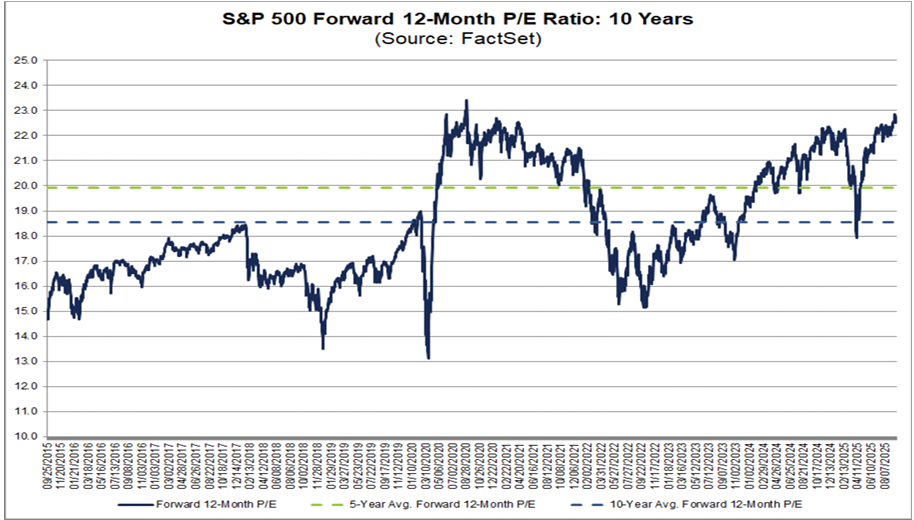

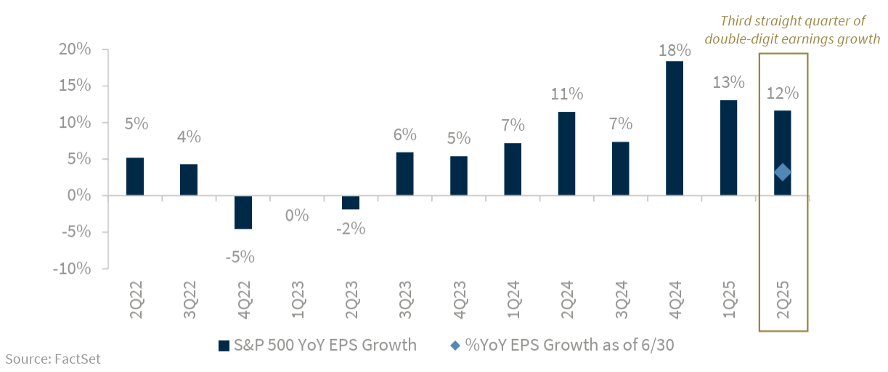

☑ Stock market at record highs

☑ Accelerating investment in AI

☑ Resilient consumer spending

☑ Labor market losing momentum

☑ Housing sector stagnating

☑ Rising layoffs and credit card delinquencies

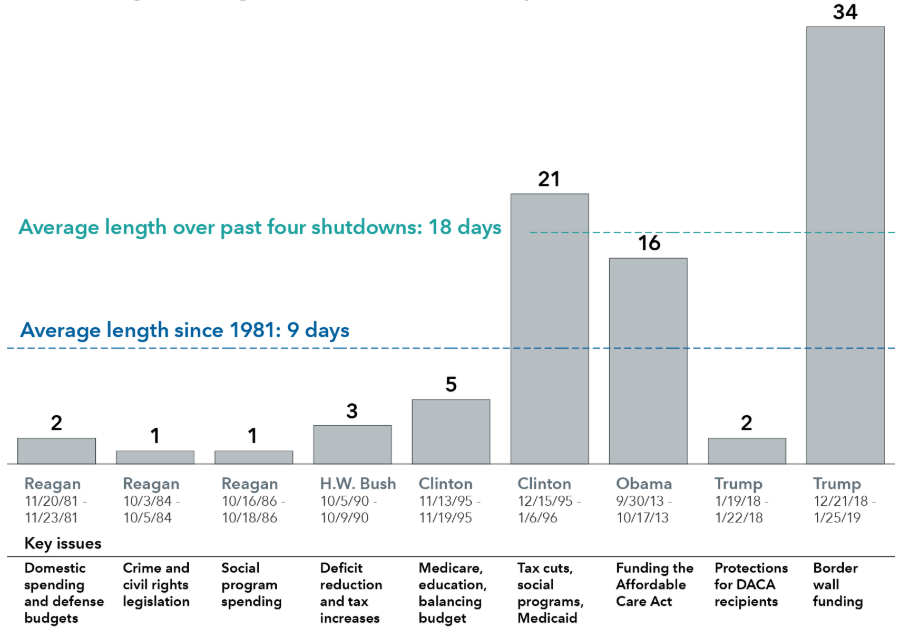

☑ Government shutdown delaying key data, reducing visibility for both the Fed and the markets

A divided Fed doesn’t imply chaos, but rather caution in the face of an ambiguous economy and incomplete data.

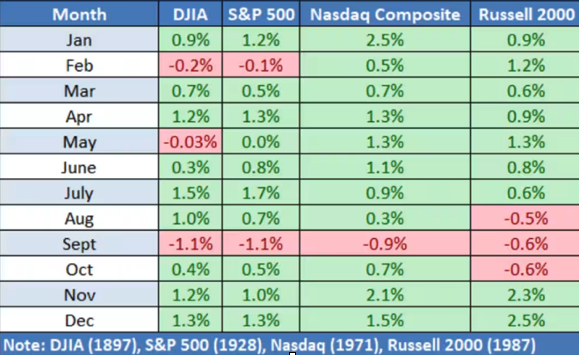

The message for investors is clear: it’s not about predicting the next move, but about staying disciplined and focused on long-term horizons.

Source: Morningstar