June Inflation: Mixed Signals and Tariff Watch

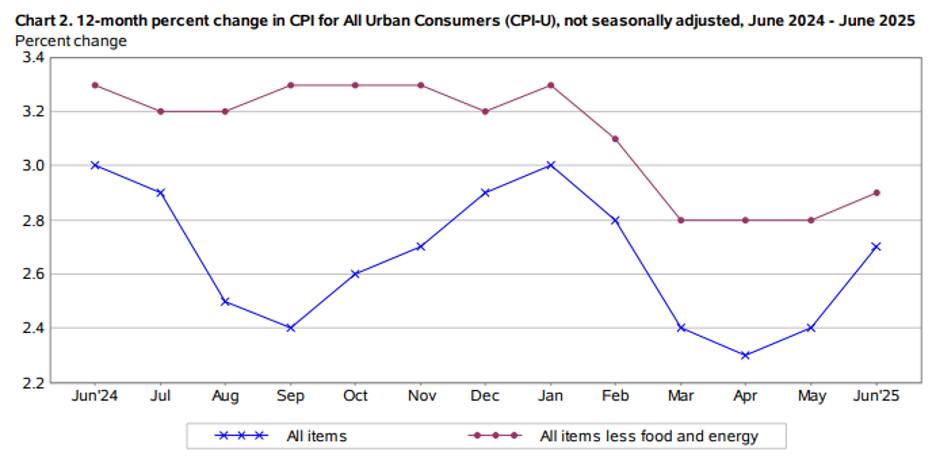

The June inflation report in the U.S. showed a modest monthly uptick, while underlying price pressures remain contained. The Consumer Price Index (CPI) rose 0.3% in line with expectations, while the annual rate increased to 2.7%, just above the 2.6% forecast. Core inflation rose 0.2% month-over-month and 2.9% year-over-year, showing no major surprises.

Where are the biggest shifts?

- Food and durable goods saw a 0.3% increase, driven by higher prices for coffee, beverages, and household items. In contrast, prices for new and used cars continued to decline, helping ease core inflation.

- Services and energy were mixed. Gasoline prices rose 1.0% after four months of declines, and the housing index climbed 0.3%. Meanwhile, hotel and air travel costs edged down slightly, pointing to still-moderate demand.

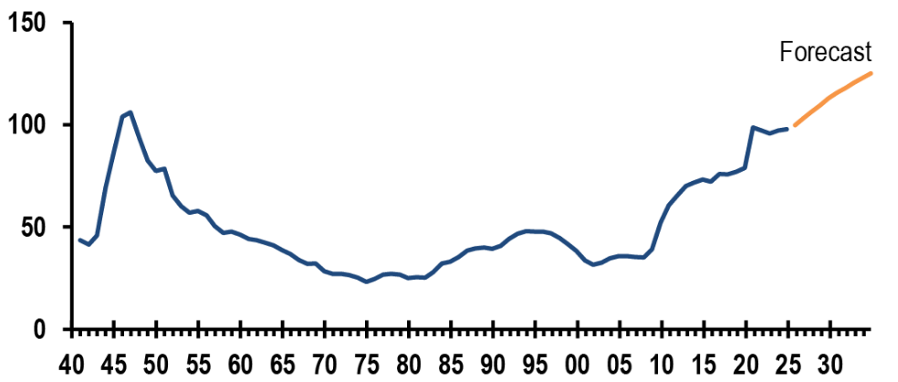

Despite the overall uptick, the market remains cautious. Attention is now on the potential impact of new tariffs set to take effect in August, particularly affecting electronics, apparel, and automobiles.

Market implications:

Markets are not expecting rate cuts before September, as they assess the effects of new tariffs amid ongoing political pressure for a more accommodative monetary policy.

Annual headline inflation rose from 2.4% in May to 2.7% in June, while core inflation edged up from 2.8% to 2.9%.