Although President Trump has criticized the Fed, the legal basis for dismissal appears weak

Despite recent criticisms from former President Donald Trump toward the Federal Reserve (Fed), the possibility of an early removal of Fed Chair Jerome Powell seems limited. The Federal Reserve Act of 1913 does not grant the Executive Branch the authority to dismiss its officials due to disagreements over monetary policy. In addition, a recent Supreme Court decision further reinforced the central bank’s independence, making intervention even more difficult. Although the law allows for removal “for cause,” this clause has never been tested, leaving the legal grounds for dismissal uncertain.

Against this backdrop, three scenarios emerge regarding the Fed’s future under new leadership:

The Fed would maintain a technical approach, free from political pressure.

- More predictable policy

- Lower inflation

- Greater long-term stability

- In the short term: a flatter yield curve and wider credit spreads

A more flexible stance could lead to more expansive policies.

- Boost to short-term growth and inflation

- Result: steeper yield curve and higher inflation expectations

The Fed could succumb to pressure to keep rates low despite high inflation.

- Loss of credibility

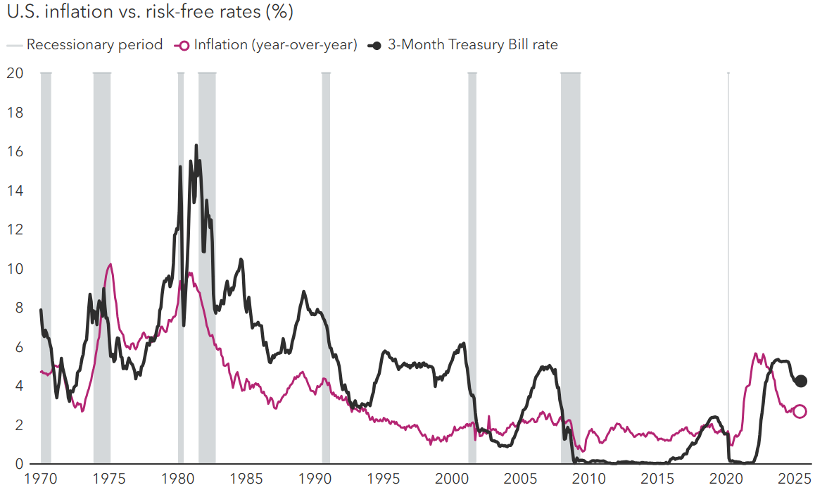

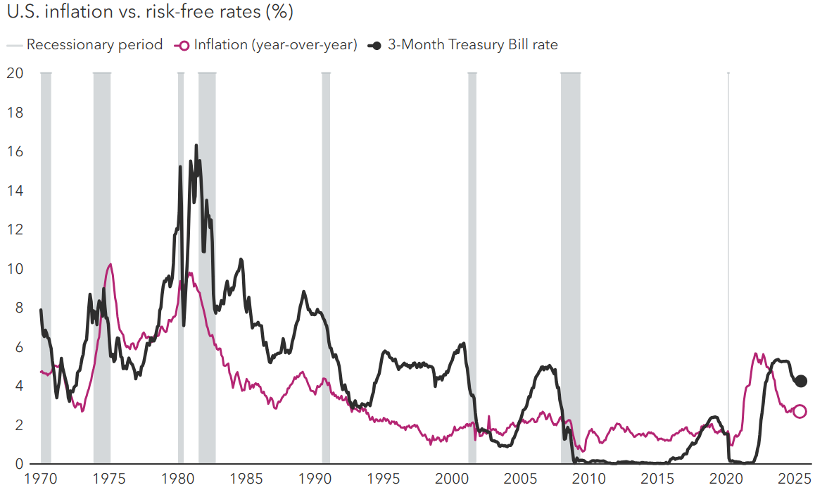

- High volatility and potential abrupt adjustments, as in the Volcker era (1979)

However, early dismissal could trigger:

- Temporary volatility spikes

- Weaker U.S. dollar

- Stock market declines

- Distortion of the yield curve

Since the 1970s, the Fed has remained committed to controlling inflation as a core institutional priority.

Source: Capital Group