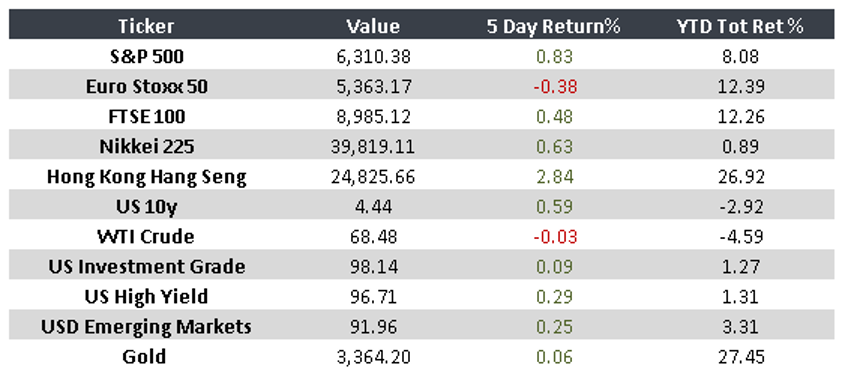

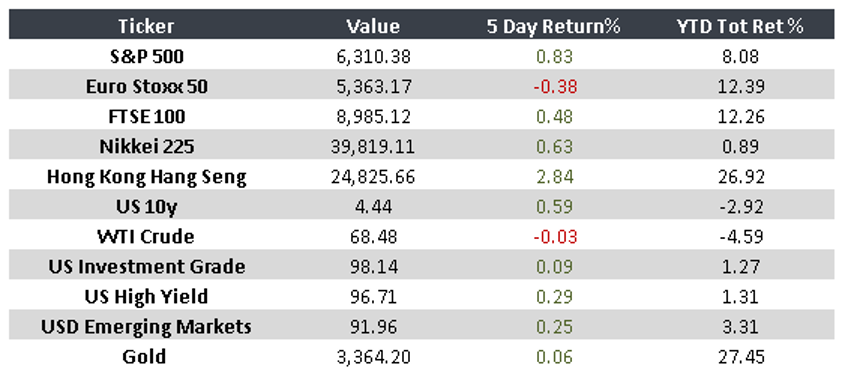

Inflation edges up, solid earnings reports, and signs of economic resilience

Week of July 14–18

A key week for markets, marked by economic data, fiscal decisions, and mixed signals across the globe.

Investors closely monitored inflation, consumption, and growth figures. Here are some of the most relevant developments:

- U.S.: June retail sales beat expectations, showing resilient consumer demand. However, annual inflation rose to 2.7% due to higher tariffs. Q2 2025 earnings season began on a positive note.

- Europe: UK inflation in June hit its highest level since January, reducing expectations of further rate cuts. In Germany, the government approved a fiscal stimulus package to support economic growth.

- China: June exports exceeded expectations amid a fragile tariff truce with the U.S. GDP grew at an annualized rate of 5.2% in Q2, reflecting continued economic resilience.

- Brazil: The government projects gross debt will rise from 71.7% of GDP at the start of Lula’s administration to 82.3% by 2026, pointing to mounting fiscal pressure.

- Mexico: The U.S. announced a 17% tariff on Mexican tomatoes. President Sheinbaum signaled interest in strengthening trade ties with Canada after speaking with Prime Minister Mark Carney.

“ Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves”.— Peter Lynch

Key Upcoming Events:

- U.S.: Speech by Jerome Powell – 07/22

- U.S.: Housing sector data release – 07/24

Monitor