Expectations for the 1Q24 corporate reports

Expectation of 3 cutbacks for this year still latent

How has the Federal Reserve acted on election years?

News

We share updated information to support you in making informed decisions.

Categories

Top Posts

Expectations for the 1Q24 corporate reports

0 Comments

Quarterly earnings season will begin in the coming weeks. The most recent report indicates that the analyst consensus anticipates annual earnings growth for the S&P 500 of 3.4% (YoY) for the first quarter of the year. If confirmed, this could mark the third...

Expectation of 3 cutbacks for this year still latent

0 Comments

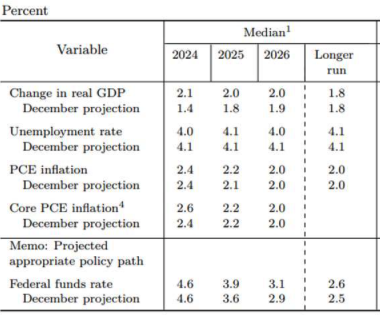

The Federal Reserve (FED) made the unanimous and widely anticipated market decision to once again leave the target range for the federal funds rate unchanged at 5.25% - 5.50%, its highest level in the last 22 years. Since July 2023, the FED has not changed the target...

How has the Federal Reserve acted on election years?

0 Comments

With monetary policy generating much anticipation in the macroeconomic and financial outlook for this year, it is inevitable that investors will wonder how the presidential election might influence the Federal Open Market Committee (FOMC). Historically, the Federal...

Global Monitor of Inflation: persistent at 3%

0 Comments

According to JP Morgan's monitoring, both headline and core global inflation, excluding China and Turkey (where China is experiencing deflation and Turkey has a double-digit inflation rate), increased slightly by 0.3% on a monthly basis in January. While their annual...

Letter from Warren Buffett in 2023 to Berkshire Hathaway shareholders

0 Comments

Recently, the renowned investor and Berkshire Hathaway Chairman, Warren Buffett, shared his annual 2023 letter with the company's shareholders. Similar to previous years, the letter places less emphasis on 'news' and more on providing valuable reminders to investors...

The AI boom and its potential benefit in a variety of activities

0 Comments

With the launch of ChatGPT a little over a year ago, as well as other artificial intelligence (AI) tools, the exponential growth of these new technologies continues to arouse particular interest due to their contribution to generate important advances in productivity,...

NEWSLETTER