Week December 15–19

In a relatively calm week, employment and consumption indicators provided key signals across major economies. Central bank decisions continue to reflect a cautious, data – dependent approach, while global economies show divergences between production and consumption that reinforce the need for selective analysis heading into 2025.

United States

- Nonfarm payrolls exceeded expectations, adding 64,000 jobs in November.

- The unemployment rate rose to 4.6%.

- Headline inflation eased to 2.7% and core inflation to 2.6%.

Europe

- The ECB held rates at 2.15% and revised its growth outlook.

- Eurozone inflation stood at 2.1%.

- Germany and Spain recorded 2.6% and 3.2%, respectively.

- The United Kingdom cut its policy rate to 3.75%.

China

- Industrial production grew 4.8% year over year in November.

- Retail sales rose just 1.3%, the weakest increase since December 2022.

- Sharp declines in automobiles, household appliances, and construction materials.

Argentina

- GDP expanded 3.3% year over year in 3Q, below expectations.

- Manufacturing output declined 2.4%.

- The unemployment rate fell to 6.6%, approaching historical lows.

Brazil

- Economic activity declined 0.2% month over month.

- Agriculture helped prevent a deeper contraction.

- The central bank revised its GDP growth forecast upward and maintained a restrictive stance to contain inflation.

Mexico

- Banxico cut its policy rate to 7%.

- Retail sales increased 3.4% year over year, driven by strong online sales.

- Employment in the sector rose 1%, while wages increased 3.3%.

“The first rule of compounding: Never interrupt it unnecessarily.” — Charlie Munger

Key Upcoming Events

- United States: Quarterly GDP growth release — December 23

- United States: Labor market data release — December 24

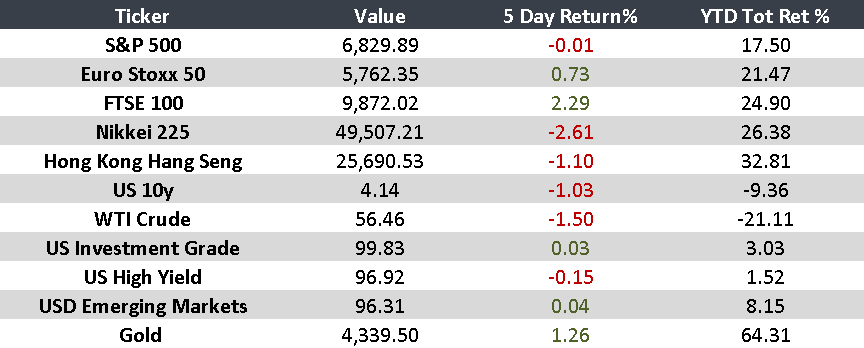

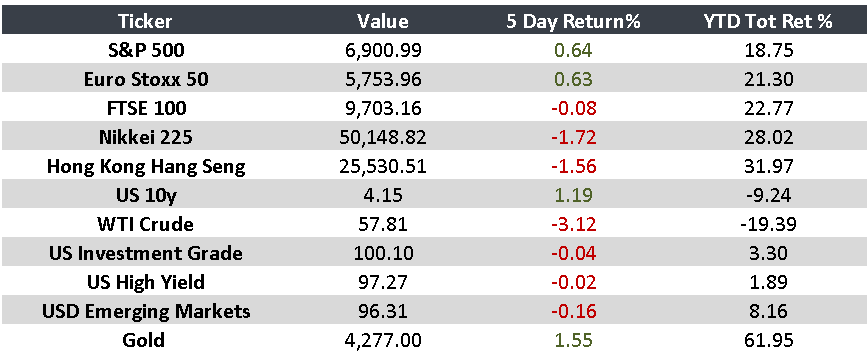

Monitor

Returns as of 10 AM EST