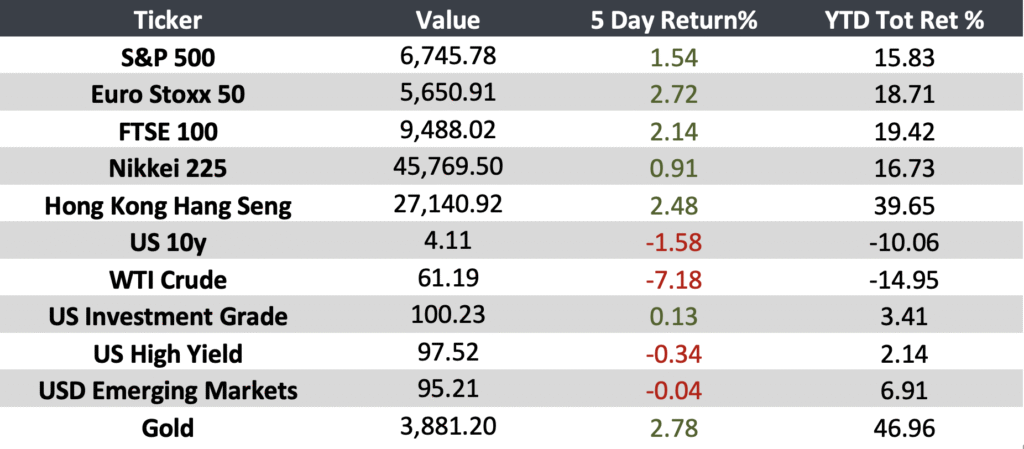

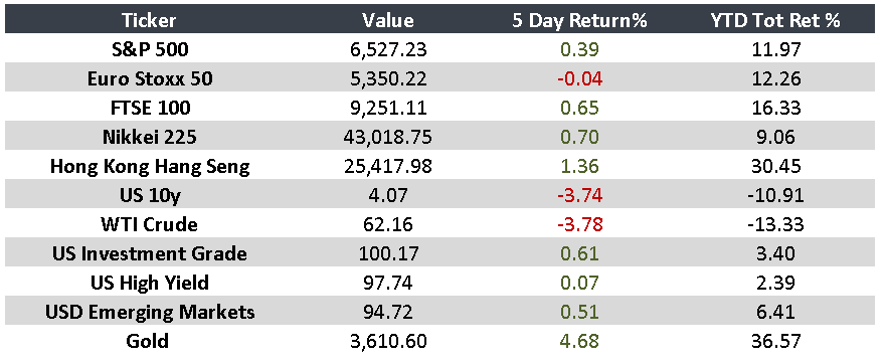

Week: October 27-31

The week was marked by mixed signals in global markets following a series of key events. These included the Federal Reserve’s (Fed) second consecutive policy rate cut, the extension of the tariff truce between the United States and China, the stagnation of the German economy, and the improvement in China’s industrial profits. These developments underscore the complexity of the global economic and trade environment.

United States:

- The Federal Reserve cut the policy rate to a range of 3.75% – 4.00%.

- Trump and Xi agreed to extend the tariff truce for one more year.

- Consumer confidence fell to its lowest level in six months.

- Earnings season continues to show strength, with S&P 500 earnings growing about 10% this quarter.

Europe

- The European Central Bank (ECB) kept its key rate at 2%.

- Germany’s economy stagnated due to weaker exports and ongoing global trade pressures, despite a slight improvement in business sentiment.

Japan

- The government highlighted a moderate recovery supported primarily by capital spending.

- Caution persists due to risks linked to U.S. trade policy.

China:

- Industrial profits rose 21.6% YoY in September, the fastest pace since November 2023. This reflects better capacity utilization.

Brazil

- The U.S. Senate approved a bill to revoke tariffs on Brazil by lifting the national emergency declaration issued in July.

Mexico:

- Gross Domestic Product (GDP) contracted 0.3%YoY in 3Q25.

- According to President Sheinbaum, the United States extended the negotiation period to avoid the implementation of a 30% tariff.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” – Albert Einstein

Key Upcoming Events

- U.S.: ISM Manufacturing – Nov 3.

- U.S.: ISM Services & employment-related data (tentative) – Nov 5-7.

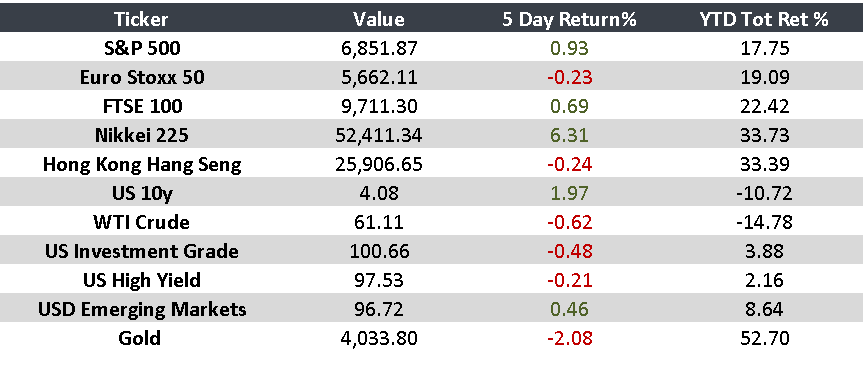

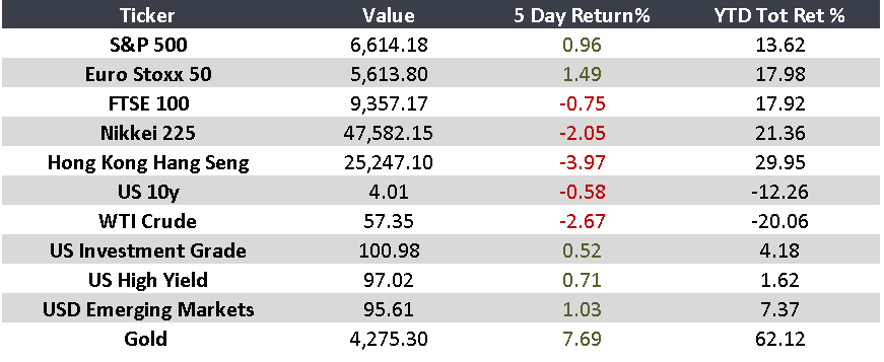

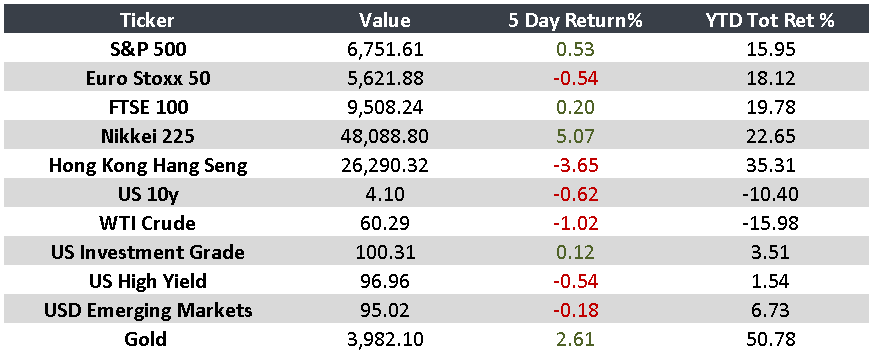

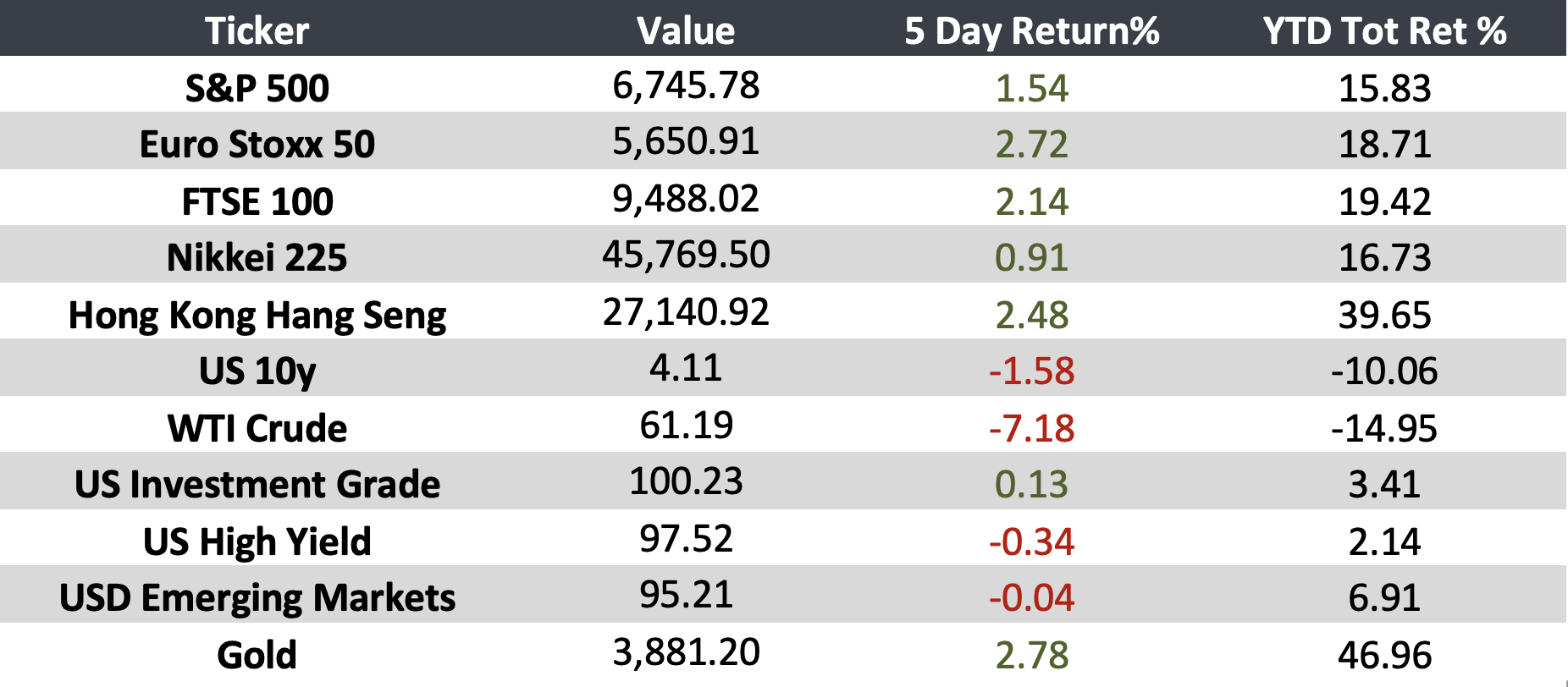

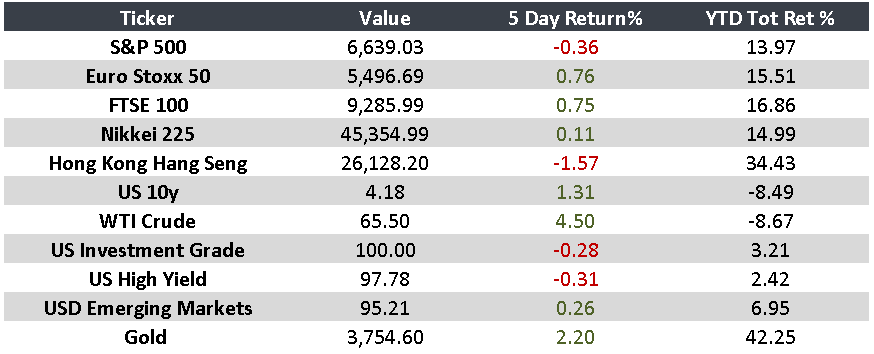

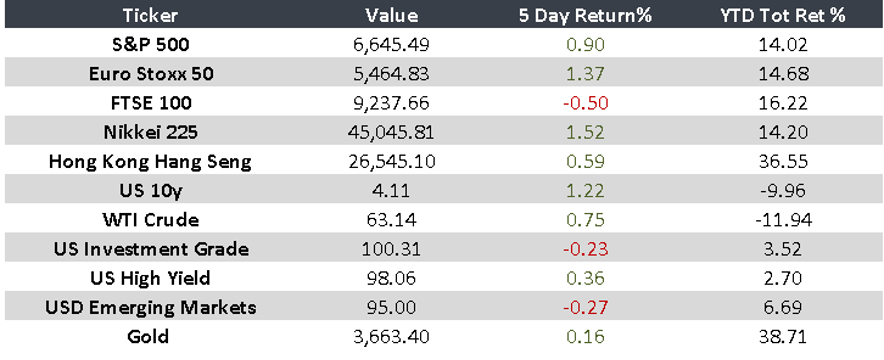

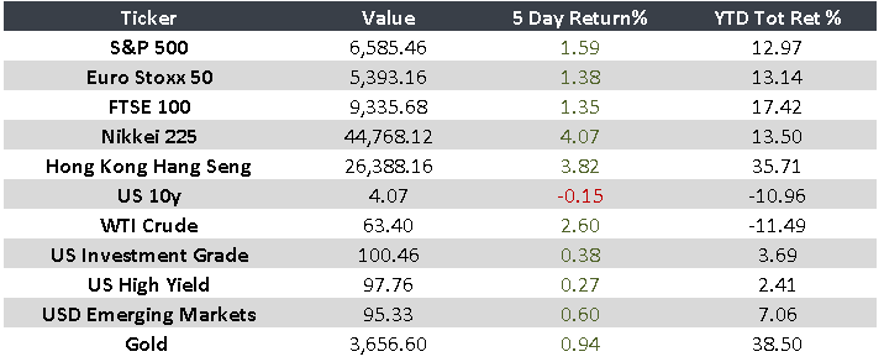

Monitor